Impulse aus Kultur und Wirtschaft: Mit der hkp///group den Frühling feiern

Newsletter April 2024

Aktuelle Themen aus HR & Corporate Governance: u.a. Frühlingsempfang, Klimaschutz bei der hkp///group, Die hkp///group Story, Zukunft der Corporate Governance, Vorstandsvergütung im Fokus, hkp///group Transformation Lab, Gender Pay Gap, ESG mehr ...

Videostatements zur Corporate Governance Konferenz am 19. April 2024 in Frankfurt am Main

Perspektiven auf die Zukunft der Corporate Governance

Was sind die zentralen Herausforderungen der Corporate Governance im Spannungsfeld von Transformation und Nachhaltigkeit? Videostatements im Kontext unserer Konferenz zu ebendieser Frage liefern unterschiedliche Perspektiven. mehr ...

Michael H. Kramarsch und Regine Siepmann im Interview

Corporate Governance im Wandel: Intensiverer Dialog aller Akteure notwendig

Am 19. April 2024 findet in Frankfurt die Corporate Governance Konferenz der hkp/// group statt. hkp.com sprach mit Michael H. Kramarsch und Regine Siepmann über die Herausforderungen guter Unternehmensführung. mehr ...

Ein Fachartikel von hkp/// group Corporate Governance Advisor Nina Grochowitzki

Vergütung Deutschland - Update der Glass Lewis Abstimmungsrichtlinien 2024

Glass Lewis hat die Proxy Voting Guidelines 2024 für Deutschland sowie Kontinentaleuropa veröffentlicht. Diese treten mit sofortiger Wirkung für die anstehenden Hauptversammlungen in Kraft. Die Änderungen zum Thema Vergütung im Überblick. mehr ...

Ein Fachartikel von hkp/// group Corporate Governance Advisor Dr. Pia Lünstroth

Vergütung Austria – Update der Glass Lewis Abstimmungsrichtlinien 2024

Von Durchgängigkeit bei Änderungen in der Vergütungspolitik bis hin zu Pay for Performance im Vergütungsbericht: Die wesentlichen Neuerungen in den Anforderungen des Stimmrechtsberaters an die börsennotierten Unternehmen Österreichs. mehr ...

Videostatement von Corporate Governance Advisor Dr. Pia Lünstroth

Die Besonderheiten der Hauptversammlungs-Saison 2024 in Österreich

Coporate Governance Advisor Dr. Pia Lünstroth erklärt, was die Hauptversammlungs-Saison 2024 in Österreich besonders macht und lädt zur hkp/// group Webinar Serie ein. mehr ...

Unternehmensberatung übernimmt Spezialisten für Gremien-Evaluierung - Europäisches Netzwerk geplant

Börsen-Zeitung: hkp/// group baut Angebot für Aufsichtsräte aus

Die Börsen-Zeitung berichtet über die Übernahme der ECBE sowie die Schaffung einer europäischen Plattform für die unabhängige Beratung von Aufsichtsräten durch die hkp/// group. Der Artikel steht Ihnen zum Download zur Verfügung. mehr ...

Stärkung der Kompetenzen in der Evaluation, Organisation sowie Zusammenarbeit von Aufsichtsgremien

hkp/// group stärkt Corporate Governance Beratung durch Übernahme von ECBE

Die hkp/// group übernimmt die Mehrheit an der European Center for Board Effectiveness GmbH. ECBE ist spezialisiert auf die Evaluierung und Beratung zur Arbeit von Aufsichts- und Verwaltungsgremien. mehr ...

hkp.com im Gespräch mit Corporate Governance Advisor Dr. Pia Lünstroth.

ATX: Nachhaltigkeit in Aufsichtsrat und Vorstandsvergütung

Was sagen die Abstimmungsrichtlinien führender ATX-Investoren und Stimmrechtsberater zur Implementierung von Nachhaltigkeit in Vorstandsvergütung und Aufsichtsrat? hkp.com im Gespräch mit Corporate Governance Advisor Dr. Pia Lünstroth. mehr ...

hkp/// group Corporate Governance Advisor Dr. Thomas Kopelke in der Fachzeitschrift DER BETRIEB

Kompetenz im Aufsichtsrat: die Qualifikationsmatrix in der Praxis

Laut DCGK soll der Aufsichtsrat einer börsennotierten Gesellschaft ein Kompetenzprofil erarbeiten und den Umsetzungsstand in einer Qualifikationsmatrix offenlegen. Dr. Thomas Kopelke berichtet in DER BETRIEB über die Marktpraxis. mehr ...

Ein Event-Rückblick von Dr. Laura Bundle und Dr. Thomas Kopelke

22. MACIE Workshop on Corporate Governance and Investment

Am 15. und 16. September 2023 diskutierten Ökonomen aus ganz Europa aktuelle Arbeiten im Themenfeld Corporate Governance und Finance. Event-Insights liefern die Corporate Governance Advisors Dr. Laura Bundle und Dr. Thomas Kopelke. mehr ...

Dr. Jan Dörrwächter und Dr. Pia Lünstroth im Interview

Corporate Governance in Österreich: Erfolgsfaktoren für die Hauptversammlung 2024 – Vergütungspolitik & Nachhaltigkeit

2024 wird bei vielen österreichischen Unternehmen auf der Hauptversammlung zum zweiten Mal über die Vergütungspolitik abgestimmt. Was lässt sich aus zurückliegenden Voten lernen? Dr. Jan Dörrwächter und Dr. Pia Lünstroth im Interview. mehr ...

Ergebnisse einer aktuellen Studie von ECBE und hkp/// group

Aufsichtsratskompetenzen – Auf dem Weg in die standardisierte Transparenz

Ergebnisse und Erkenntnisse einer aktuellen Studie von ECBE und hkp/// group zu individuellen Kompetenzen von Aufsichtsräten in börsennotierten Unternehmen mehr ...

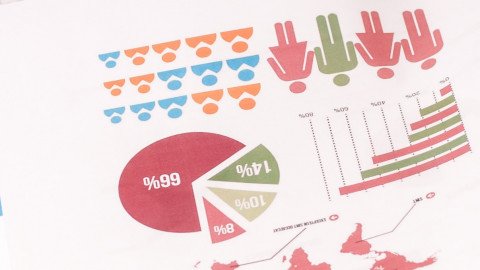

hkp/// group Analyse belegt sinkende Investoren-Akzeptanz zu DAX-Vergütungsberichten

Vorstandsvergütung: Durchwachsenes Investoren-Feedback zu Vergütungsberichten

Rückblick auf die Abstimmungen zu den Vergütungsberichten der führenden börsennotierten Unternehmen in Deutschland - Durchwachsenes Bild für die Hauptversammlungssaison 2023 mehr ...

Ein Gespräch mit Dr. Jan Dörrwächter und Dr. Pia Lünstroth

Der Aufsichtsrat in Unternehmensumstrukturierungen und IPOs

Umstrukturierungen und IPOs erfordern gute Vorbereitung und eine gute Unternehmensführung. In diesem Zusammenhang gewinnt die Rolle des Aufsichtsrats als Wächter guter Corporate Governance eine herausragende Bedeutung. mehr ...

Die Anforderungen steigen – Einblicke in die Agenda des Aufsichtsrats

Die hkp/// group Corporate Governance Advisors Nina Grochowitzki, Dr. Pia Lünstroth und Regine Siepmann im Gespräch zu aktuellen Themen der Aufsichtsratstätigkeit mehr ...

Eine hkp/// group Studie des Beratungsbereichs Corporate Governance Advisory

Nachhaltigkeit im Spiegel von Investoren-Erwartungen

Eine hkp/// group Studie hat die Abstimmungsrichtlinien von DAX-Investoren in puncto Nachhaltigkeit analysiert. Ergebnisse verrät Regine Siepmann hier auf hkp.com sowie in einem Gastkommentar für die Börsen-Zeitung. mehr ...

Michael H. Kramarsch im Gespräch mit der Börsen-Zeitung

„ESG muss in alle Unternehmensprozesse“

Michael H. Kramarsch sprach mit der Börsen-Zeitung über die Verankerung von Nachhaltigkeit durch ESG-Ziele im Aufsichtsrat. Der Artikel steht Ihnen hier zum Download zur Verfügung. mehr ...

hkp/// group Remote Talk Serie zum Handlungsfeld Human Capital Management

Human Capital Management: die Erwartungen von Investoren

„Know your new customers“ – das raten hkp/// group Managing Partner Michael H. Kramarsch und Senior Partnerin Regine Siepmann Personalverantwortlichen, wenn es um den zunehmenden Investoren-Fokus auf People-Themen geht. mehr ...

Ein Kommentar von Michael H. Kramarsch für die NZG (Neue Zeitschrift für Gesellschaftsrecht)

Trends in der Vorstandsvergütung: Grau, teurer Freund, ist alle Theorie!

hkp/// group Managing Partner Michael H. Kramarsch kommentiert in der Neuen Zeitschrift für Gesellschaftsrecht (NZG) regulatorische Neuerungen in der Vorstandsvergütung. mehr ...

hkp/// group Remote Talk Serie zum Handlungsfeld Human Capital Management

Human Capital Management: die richtigen KPIs verfügbar machen

„Know your game“ – das raten die hkp/// group Beraterinnen Anna-Maria Hirschfeld und Petra Knab-Hägele Personalverantwortlichen, wenn es um den zunehmenden Investoren-Fokus auf People-Themen geht. mehr ...

Lehren aus der Kritik zum Vergütungsbericht nach § 162 AktG

Vorstandsvergütung im Visier von Investoren

Nach der durch das ARUG II geänderten Fassung des Aktiengesetzes (AktG) müssen börsennotierte Gesellschaften jährlich ein konsultatives Votum der Hauptversammlung zum Vergütungsbericht nach § 162 AktG einholen. mehr ...

Ein Mehr an Verantwortung und Haftung erfordert gezielte Aus- und Weiterbildung

Qualifizierung für Aufsichtsräte: Es braucht einen nachhaltigen Ansatz

Die Aufgaben von Aufsichtsräten sind vielfältiger geworden – und damit auch ihre Verantwortung und Haftung. Eine fortlaufende Qualifizierung ist unumgänglich. mehr ...

Aktuelle Informationen von Nina Grochowitzki, Dr. Pia Lünstroth und Regine Siepmann

EU-Mustertabellen: Neue Entwurfsfassung veröffentlicht

Am 22.09. hat die EU-Kommission eine neue Entwurfsfassung der Mustertabellen für die Offenlegung der Vergütung von Vorständen und Aufsichtsräten im Vergütungsbericht veröffentlicht. Über aktuelle Entwicklungen informieren wir Sie gerne. mehr ...

Ein Kommentar von Tobias Blumenstein und Dr. Pia Lünstroth

Vorstandsvergütung verpflichtend auf dem Prüfstand

Eine Kommentierung der Say-on-Pay-Ergebnisse börsennotierter Unternehmen im Kontext neuer Corporate-Governance-Rahmenbedingungen und Erkenntnissen einer Studie der Universität Göttingen und hkp/// group. mehr ...

Neue SEC-Vorgaben für die Vorstandsvergütung – Handlungsbedarf für US-Emittenten in 2023

Die US-amerikanische Börsenaufsicht SEC hat im August 2022 die finale Fassung ihrer neuen Pay versus Performance (PVP) Direktive veröffentlicht. mehr ...

Human Capital Management wird kurzfristig die breite Unternehmenslandschaft betreffen

HCM ist kein Modethema

Human Capital Management und ESG als Fokus-Themen des DGFP Netzwerktreffens vom 08. September 2022 mehr ...

hkp/// group Remote Talk Serie zum Handlungsfeld Human Capital Management

Erklären, wie die Personalstrategie zum Unternehmenserfolg beiträgt

HR hat zukünftig stärker darzustellen, wie die Personalstrategie auf die Unternehmensstrategie einzahlt und wie sie zum Erfolg beiträgt, so die hkp/// group Partner Johannes Brinkkötter und Frank Gierschmann im hkp/// group Remote Talk. mehr ...

hkp/// group Remote Talk Serie zum Handlungsfeld Human Capital Management

HR-Risikomanagement mit konkreten KPIs

Wie kann HR dem steigenden Investoren-Interesse an People Themen und entsprechenden Risiken in diesem Bereich gerecht werden? Diese Frage beantworten Dr. Harriet Sebald und Frank Gierschmann aus dem Partner-Kreis der hkp/// group. mehr ...

hkp/// group Remote Talk Serie zum Handlungsfeld Human Capital Management

Der Dialog zwischen HR und Investoren: Be there!

Welche Handlungsbedarfe ergeben sich für HR aus dem Investoren-Interesse an People Themen? Diese Frage beantworten hkp/// group Expert:innen in einer Remote Talk Serie. Dr. Harriet Sebald und Michael H. Kramarsch zum Investorendialog. mehr ...

Vom Shareholder- zum Stakeholder-Kapitalismus? Ein Videostatement von Michael H. Kramarsch

Investoren als Treiber von Nachhaltigkeitszielen

Mehr denn je machen Investoren ihren Einfluss in der Corporate Governance geltend und forcieren Nachhaltigkeitsziele (ESG). Entwickeln wir uns vom Shareholder- zum Stakeholder-Kapitalismus? Michael H. Kramarsch über zentrale Entwicklungen. mehr ...

Ein Videostatement von hkp/// group Vergütungsexpertin Regine Siepmann

ESG-Ziele in der Vorstandsvergütung

Investoren reden beim Thema Vorstandsvergütung mit. Welche Konsequenzen ihr zunehmender Fokus auf Nachhaltigkeit auch mit Blick auf die Vergütung von Vorständen hat, erläutert hkp/// group Partnerin Regine Siepmann. mehr ...

hkp/// group Analyse Vorstandsvergütung DAX 2021

DAX-Vorstandsvergütung – Chaos mit Ansage im Vergütungsausweis

Mehr Vergütungsinformationen führen zu höherer Transparenz aber geringerer Vergleichbarkeit – Erstmals kein Ranking der individuellen Top-Vergütungen im DAX. Durchschnittliche Vergütung von Vorstandsvorsitzenden beträgt 8,3 Mio. Euro. mehr ...

Die wichtigsten Fragestellungen zum Reporting der Vergütung von Vorstand und Aufsichtsrat auf Basis aktueller regulatorischer Vorgaben sowie Investorenerwartungen

How to Vergütungsbericht: Kernfragen im Reporting zur Vorstandsvergütung

Die wichtigsten Fragestellungen zum Reporting der Vergütung von Vorstand und Aufsichtsrat auf Basis aktueller regulatorischer Vorgaben sowie Investorenerwartungen mehr ...

Dr. Jan Dörrwächter und Johannes Harrack im Interview

Maximalvergütung: Implikationen für die Vergütungssysteme für den Vorstand

Mit der Zweiten Europäischen Aktionärsrechterichtlinie sind Regelungen zur Maximalvergütung in das Aktiengesetz eingefügt worden. Dr. Jan Dörrwächter und Johannes Harrack erläutern die Konsequenzen für die Vergütungssysteme. mehr ...

Ein Beitrag von Pay Governance, strategischer hkp/// group Partner in Nordamerika und Asien

IPO Readiness: To Dos for Board and Compensation Committees

Ein Börsengang betrifft alle Kernelemente eines Unternehmens. Neben Aspekten wie der Incentivierung von Führungskräften, ergeben sich weitere Aufgaben und Governance-Themen für das Top-Management und die Geschäftsleitung. mehr ...

Dr. Jan Dörrwächter und Petra Knab-Hägele im Fachmagazin Der Aufsichtsrat

Vorstands- und Führungskräftevergütung im Rahmen von Börsengängen

Die Vergütung von Vorstand, Aufsichtsrat und Führungskräften ist ein entscheidender Erfolgsfaktor im Rahmen eines Börsengangs. Dr. Jan Dörrwächter und Petra Knab-Hägele erläutern in Der Aufsichtsrat, worauf zu achten ist. mehr ...

Stellungnahme zum Fragen-und-Antworten-Papier des IDW zur Erstellung des Vergütungsberichts nach § 162 AktG

Für eine praxistaugliche Vergütungstransparenz

Das Fragen-und-Antworten-Papier des IDW zum Vergütungsbericht nach §162 AktG erweist sich als Herausforderung für Unternehmen in der praktischen Umsetzung. Die hkp/// group Stellungnahme für eine praxisnahe und investorengerechte Auslegung. mehr ...

Ein Bericht von Sabine Wadewitz, Börsen-Zeitung, mit Einschätzungen von Michael H. Kramarsch und Regine Siepmann

Vergütungstransparenz in der Diskussion

Sabine Wadewitz, Börsen-Zeitung, berichtet über den laufenden Streit der Auslegung der gesetzlich angepassten Normen zur Veröffentlichung der Managergehälter. Einschätzungen hierzu liefern Michael H. Kramarsch und Regine Siepmann. mehr ...

Ein Gastkommentar in der Börsen-Zeitung von Michael H. Kramarsch

Facebook: Sind soziale Medien sozial nachhaltig?

Vor dem Hintergrund steigender Anforderungen an ESG-Ziele widmet sich hkp/// group Managing Partner Michael H. Kramarsch in einem Gastkommentar für die Börsen-Zeitung dem Geschäftsmodell und der Sozialverantwortung sozialer Medien. mehr ...

The most comprehensive analyses of worldwide market practice of equity-based compensation

Global Equity Insights Survey 2021

Volatile Märkte, äußere Faktoren und globale Schocks haben Aktienprogramme letztes Jahr stark beeinflusst, so ein Ergebnis des Global Equity Insights Survey 2021. Detaillierte Einsichten erhalten Sie im Studien-Flyer (in Englisch). mehr ...

hkp.com im Gespräch mit den Vergütungsexpertinnen Dr. Pia Lünstroth und Jennifer S. Schulz

ATX: Deutliche Fortschritte im Vergütungsausweis

Aktuelle Entwicklungen in der Vergütung von Vorstands- und Aufsichtsratsvorsitzenden in den führenden börsennotierten Unternehmen Österreichs (ATX). hkp.com im Gespräch mit den Vergütungsexpertinnen Dr. Pia Lünstroth und Jennifer S. Schulz. mehr ...

Presseinformation zur hkp/// group Analyse "Executive and Non-Executive Director Compensation in Europe 2020"

Corona wirbelt CEO-Vergütung in Europa durcheinander

Die hkp/// group Analyse "Executive and Non-Executive Director Compensation in Europe 2020" verzeichnet krisenbedingte Vergütungsverzichte des Top-Managements. Bezüge der CEOs in STOXX-Unternehmen 2020 auf geringstem Niveau seit 2011. mehr ...

Interview mit Kay Bommer, Geschäftsführer des DIRK – Deutscher Investor Relations Verband

HCM: Neue Anforderungen an Investor Relations

Nachdem BlackRock Anfang des Jahres seine Aufmerksamkeit stärker auf das Human Capital Management (HCM) gerichtet hat, stellt sich für IR die Frage nach den Konsequenzen. hkp.com im Gespräch mit DIRK-Geschäftsführer Kay Bommer. mehr ...

hkp/// group Analyse „Geschäftsberichtsauswertung Aufsichtsratsvergütung DAX 2020“

DAX-Aufsichtsratsvergütung 2020: Rückläufige Bezüge bei gestiegener Arbeitsbelastung

Die durchschnittliche Gesamtvergütung der Aufsichtsratsvorsitzenden im DAX sinkt 2020 um rund 4 %. Der Rückgang stützt sich vor allem auf Vergütungsverzichte. Ergebnisse der „Geschäftsberichtsauswertung Aufsichtsratsvergütung DAX 2020“. mehr ...

Michael Kramarsch und Dr. Harriet Sebald im Video-Chat

Human Capital Management (HCM): Investoren-Fokus als Chance für HR

Institutionelle Investoren interessieren sich immer stärker für das Human Capital Management (HCM) in Unternehmen. Michael Kramarsch und Harriet Sebald erläutern im Video-Chat, warum dies eine Chance für das Personalmanagement ist. mehr ...

Update zur hkp/// group Analyse „Geschäftsberichtsauswertung Vorstandsvergütung DAX 2020“

hkp/// group Update: DAX-Vorstandsvergütung - zwei Exoten kippen das Gesamtbild

Jetzt veröffentlichte Rekordvergütungen der Vorstandsvorsitzenden von Delivery Hero und Linde machen aus bisherigem deutlichen Rückgang einen deutlichen Anstieg der Vorstandsvergütung im DAX 2020. Ein Update zur hkp/// group Analyse. mehr ...

Nächste Generation interner Talente steigt in die Geschäftsleitung der internationalen HR-Management-Beratung auf

hkp/// group nimmt Nina Grochowitzki, Dr. Pia Lünstroth und David Voggeser in die Partnerschaft auf

Mit Nina Grochowitzki, Dr. Pia Lünstroth und David Voggeser nimmt die hkp/// group drei neue Mitglieder in den Partner-Kreis und die Geschäftsleitung auf. Alle drei sind seit Gründung der Unternehmensberatung im Jahr 2011 an Bord. mehr ...

Analyse „hkp/// group Geschäftsberichtsauswertung Vorstandsvergütung DAX 2020“

Corona stoppt Jahrzehnt der Vergütungssteigerungen im DAX

DAX-Vorstandsvergütung erlebt größten Rückgang seit Veröffentlichungspflicht: durchschnittliche Bezüge der Vorstandsvorsitzenden im DAX sinken bisher bei stark rückläufiger Ertragslage um 28 % auf einen Durchschnitt von 5,3 Mio. Euro. mehr ...

Institutionelle Investoren fokussieren zunehmend Governance-Fragen - HCM-Aspekte werden stärker denn je priorisiert

HCM im Fokus institutioneller Investoren – Chance für HR

Zuerst lag der Investoren-Fokus auf Finanzkennzahlen, dann standen Governance-Fragen im Blickpunkt, gefolgt von einer breiteren Sicht auf Nachhaltigkeit. Mittlerweile werden Themen des Human Capital Managements (HCM) stärker priorisiert. mehr ...

Michael H. Kramarsch in einem Gastbeitrag für CAPITAL

Wir brauchen Ehrbare Investoren

In einem Gastbeitrag für CAPITAL regt Michael H. Kramarsch an, das Leitbild des Ehrbaren Kaufmanns auch auf institutionelle Investoren anzuwenden. Zudem fordert er länderübergreifende, verbindliche und extern überprüfbare Vorgaben. mehr ...

Ein Brief von Michael H. Kramarsch zu 10 Jahren hkp/// group

#10YearsForward: Gemeinsam eine positive Zukunft gestalten!

Die hkp/// group feiert 2021 ihren 10. Geburtstag - 10 Jahre Einsatz für eine bessere, zukunftsfeste Arbeitswelt, kurz: #10yearsforward. Gründer und Managing Partner Michael H. Kramarsch blickt auf das Geburtstags- und Hoffnungsjahr. mehr ...

Michael H. Kramarsch im Interview mit der Börsen-Zeitung

,,Investoren übernehmen die Meinungshoheit‘‘

Investoren machen beim Thema Nachhaltigkeit Druck und forcieren die Aufnahme von Ökologie und Diversity-Aspekten als Parameter für Vergütungsanreize. hkp/// group Managing Partner Michael H. Kramarsch im Interview mit der Börsen-Zeitung. mehr ...

hkp/// group Experten im Interview

Damit der Börsengang nicht am Vergütungssystem scheitert

Für einen erfolgreichen Börsengang bzw. IPO sind zahlreiche Vorarbeiten nötig. Die hkp/// group Experten Petra Knab-Hägele und Dr. Jan Dörrwächter erläutern im Interview mit hkp.com, welche Maßnahmen in HR- und Vergütung wichtig sind. mehr ...

Arbeitskreis namhafter Aufsichtsratsvorsitzender, institutioneller Investoren, Wissenschaftler und Corporate-Governance-Experten legt aktualisierte Leitlinien für nachhaltige Vorstandsvergütung vor

Leitlinien für eine nachhaltige Vorstandsvergütung nach ARUG II und DCGK aktualisiert

Die im Juli 2018 erstmals veröffentlichten Leitlinien für eine nachhaltige Vorstandsvergütung liegen jetzt in einer aktualisierten, mit gesetzlichen und regulatorischen Neuerungen harmonisierten Fassung vor. mehr ...

Zustimmungsquoten und Baustellen basierend auf den Say-on-Pay-Ergebnissen der führenden börsennotierten Unternehmen Österreichs in den Hauptversammlungen 2020

ATX-Unternehmen: Weckruf für die Vorstandsvergütung

Neuregelungen haben die börsennotierten Unternehmen Österreichs gezwungen, ihrer Vergütungspolitiken zu überprüfen und auf Hauptversammlungen 2020 zur Abstimmung zu stellen. Trotz Verbesserungen zeigt sich ein weiter heterogenes Bild. mehr ...

Michael H. Kramarsch über die gravierenden Folgen des EuGH-Urteils zum Privacy Shield (Schrems II)

Börsen-Zeitung: Keine Daten in die Staaten!?

Der EuGH hat das Privacy Shield Abkommen zwischen der EU und den USA gekippt - die Folgen sind aber auch Monate später nur wenig bekannt. Michael H. Kramarsch schreibt in der Börsen-Zeitung über eines der größten Handelshemmnisse jemals. mehr ...

Michael H. Kramarsch on the quality of top investors' voting guidelines regarding Management Board compensation

Investors Say-on-pay voting lacks professional standards

"With great influence comes great responsibility!" - On LinkedIn Michael H. Kramarsch explains why most of the top 40 investors lack professional standards regarding say-on-pay votings at AGMs. mehr ...

Alexandra Klein (Handelsblatt Fachmedien) und hkp/// group Experte Dr. Jan Dörrwächter im Interview

Publikation: Der neue DCGK als Impulsgeber

Bei Handelsblatt Fachmedien ist eine Beitragssammlung zu Corporate Governance in Deutschland unter der Herausgeberschaft von Dr. Jan Dörrwächter erschienen. hkp.com sprach mit ihm und Produktmanagerin Alexandra Klein. mehr ...

Presseinformation zur Studie von hkp/// group, Universität Göttingen und DIRK

Mitsprache zu Vorstandsvergütung fordert DAX-Investoren

Trotz Verbesserungen weiter wenig Licht und viel Schatten in der Qualität der Abstimmungsrichtlinien zur Vorstandsvergütung - so das Ergebnis einer Analyse der Proxy Voting Guidelines der 40 größten Investoren in DAX-Unternehmen. mehr ...

Eine gemeinsame Auswertung von DIRK, Universität Göttingen und hkp/// group zu den Proxy Voting Guidelines der Top-40-Investoren in den DAX30-Unternehmen

Studie: Vorstandsvergütung als Herausforderung für Investoren

Eine Auswertung der Abstimmungsrichtlinien der Top-40-Investoren im DAX vor dem Hintergrund der zweiten europäischen Aktionärsrechterichtlinie und deren Umsetzung in deutsches Recht ARUG II mehr ...

Regine Siepmann im hkp/// group Remote Talk

ARUG II & Say on Pay - Erfahrungen aus der Hauptversammlungssaison 2020

Die Hauptversammlungssaison 2020 hat viele Neuerungen bereit gehalten. Erste Abstimmungen zum Vergütungssystem für den Vorstand trafen auf rein virtuelle Aktionärstreffen. Regine Siepmann erläutert, welche Lehren sich ziehen lassen. mehr ...

hkp/// group Analyse „Executive and Non-Executive Director Compensation in Europe 2019“

Top-Management-Vergütung zwischen Corona-Krise und gesellschaftlicher Verantwortung

hkp/// group Analyse „Executive and Non-Executive Director Compensation in Europe 2019“ zeigt europaweit krisenbedingte Vergütungsverzichte des Top-Managements. Bezüge der CEOs in STOXX-Unternehmen für 2019 auf Vorjahresniveau. mehr ...

Dr. Jan Dörrwächter im Interview mit dem Online-Fachmagazin COMP & BEN

Incentivierung von Aufsichtsräten

Aktienhaltevorschriften als Instrument zur Incentivierung von Aufsichtsräten - Dr. Jan Dörrwächter, Experte für Organvergütung und Corporate Governance,im Interview mit dem COMP & BEN Magazin. mehr ...

Forscher der Universität Göttingen sehen Risiko für Unternehmensentwicklung

Clawback-Klauseln: Trend mit Nebenwirkungen

Eine Studie der Universität Göttingen untersucht die Wirkung von Rückforderungsklauseln in Vorstandsverträgen. Hierüber sprachen Studienleiter Prof. Dr. Michael Wolff und hkp/// group Experte Dr. Jan Dörrwächter mit der Börsen-Zeitung. mehr ...

Michael H. Kramarsch und Regine Siepmann in der Börsen-Zeitung

ARUG II: Der Aufsichtsrat wird gestärkt und geschwächt

Aufsichtsräte und Aktionäre mit neuen Pflichten in der Festlegung und Billigung von Vorstandsvergütung. Regine Siepmann und Michael Kramarsch im Gespräch mit der Börsen-Zeitung mehr ...

hkp.com im Interview mit Dr. Pia Lünstroth und Dr. Jan Dörrwächter

Vergütung nach AktRÄG: der Countdown läuft

Die zweite Aktionärsrechterichtlinie der EU und ihre Umsetzung durch das AktRÄG in Österreich bringt mit Blick auf Vergütung viele Neuerungen für anstehende Hauptversammlungen mit sich. Dr. Pia Lünstroth und Dr. Jan Dörrwächter im Gespräch. mehr ...

Regine Siepmann und Dr. Jan Dörrwächter im Interview mit hkp.com

ARUG II: Unternehmen mit Hochdruck in der Umsetzung

Das Gesetz zur Umsetzung der zweiten Europäischen Aktionärsrechterichtlinie in deutsches Recht (ARUG II) ist seit Jahresbeginn in Kraft. Über erste Erfahrungen in der Umsetzung sprechen Regine Siepmann und Dr. Jan Dörrwächter. mehr ...

Fokus Frankreich: CEO Compensation im europäischen Kontext

Einblicke in die CEO-Vergütung in den Top-Unternehmen in Frankreich (CAC40) unter Berücksichtigung aktueller regulatorischer und gesetzlicher Neuerungen (in englischer Sprache) mehr ...

Branchenexperte und ehemaliger hkp/// group Senior Partner Joachim Kayser zum Thema Top-Management-Vergütung in der Immobilienwirtschaft

Für mehr Nachhaltigkeit in der Vergütung

Der ehemalige hkp/// group Senior Partner Joachim Kayser im Gespräch zum Leitfaden Nachhaltige Management- und Kompensationssysteme des Instituts für Corporate Governance in der deutschen Immobilienwirtschaft ICG. mehr ...

Entwickele mit erfahrenen Experten zukunftsweisende Lösungen für Top-Kunden

Karriere bei der hkp/// group

Gemeinsam mit erfahrenen Experten kreative und zukunftsweisende Lösungen für Top-Kunden zu entwickeln garantiert eine steile Lernkurve und echte Erfolgsmomente. Wir freuen uns, Dich kennenzulernen! mehr ...

Dr. Jan Dörrwächter und Frank Gierschmann im Interview mit hkp.com

Nachfolgeplanung – Kernaufgabe des Aufsichtsrats

Warum die Nachfolgeplanung für Vorstandspositionen ein wesentliches Element des Risikomanagements ist und was Aufsichtsräte hierbei beachten sollten. Ein Gespräch mit den hkp/// group Experten Dr. Jan Dörrwächter und Frank Gierschmann. mehr ...

Regine Siepmann und Michael H. Kramarsch über die Herausforderungen der zweiten Europäischen Aktionärsrechterichtlinie

Österreichs börsennotierte Unternehmen am Scheideweg

Im Vorfeld der Fachtagung zur neuen Europäischen Aktionärsrechterichtlinie im Oktober in Wien beleuchten Regine Siepmann und Michael H. Kramarsch bei businesscircle.at, welche Änderungen sich für börsennotierte Unternehmen ergeben. mehr ...

Dreieck zwischen Aufsichtsrat, Vorstand und Hauptversammlung neu ausbalancieren

Corporate Governance neu kalibrieren

hkp/// group Managing Partner Michael H. Kramarsch über die bevorstehende Zeitenwende der Corporate Governance und den Handlungsdruck mit Blick auf die Hauptversammlungssaison 2020. mehr ...

Regine Siepmann und Dr. Pia Lünstroth im Interview mit hkp.com

Zeitenwende für die Vorstandsvergütung in Österreich

Das Aktionärsrechts-Änderungsgesetz (AktRÄG 2019) wurde am 2. Juli 2019 im österreichischen Nationalrat verabschiedet. Nach Beratung des Bundesrats am 11. Juli 2019 treten die Änderungen rückwirkend zum 10. Juni 2019 (EU-Frist) in Kraft. mehr ...

Die Vergütung von Aufsichtsratsvorsitzenden in den führenden börsennotierten Unternehmen Österreichs

Aufsichtsratsvergütung ATX 2018

Die durchschnittliche Gesamtvergütung der Aufsichtsratsvorsitzenden in den im bedeutendsten nationalen Börsen-Index ATX notierten Unternehmen Österreichs ist 2018 im Vergleich zum Vorjahr um rund 7 % gestiegen. mehr ...

Fachartikel in "Der Aufsichtsrat"

Reaktionen auf den DCGK-Entwurf

Michael H. Kramarsch, Regine Siepmann und Dr. Jan Dörrwächter fassen im Fachmagazin "Der Aufsichtsrat" die bedeutendsten Reaktionen von Kapitalmarktvertretern auf den DCGK-E zum Thema Vorstandsvergütung zusammen. mehr ...

Moderater Anstieg trotz rückläufiger Gewinne

DAX-Aufsichtsratsvergütung 2018

Die durchschnittliche Gesamtvergütung der Aufsichtsratsvorsitzenden im DAX steigt 2018 um rund 4 % auf 424.000 Euro. Gesunkener Konzernjahresüberschuss verdeutlicht Entkopplung von Unternehmenserfolg und Aktionärsinteressen. mehr ...

Europäische Aktionärsrechterichtlinie erzwingt ab 2020 fundamentale Veränderungen

ATX-Vorstandsvergütung vor Zeitenwende

Vergütungen der Vorstandsvorsitzenden in Österreichs Top-Firmen steigen 2018 um 16% – Unternehmensgewinne sinken. Die Europäische Aktionärsrechterichtlinie erzwingt ab 2020 fundamentale Veränderungen. mehr ...

Nina Grochowitzki im Video-Interview mit hkp.com

Vorstandsvergütung im DAX 2018

Die Vergütungen der Vorstandsvorsitzenden im DAX sind 2018 moderat um 3,6 % gestiegen. Ein DAX-CEO erhielt damit im Durchschnitt 7,5 Mio. Euro. Mehr Insights aus der hkp/// group Analyse verrät Senior Managerin Nina Grochowitzki im Video. mehr ...

Moderate Steigerungen und historischer Spitzenwert

DAX-Vorstandsvergütung 2018

Die Bezüge der Vorstandsvorsitzenden im DAX steigen bei stabiler Ertragslage um 3,6 % auf einen Durchschnitt von 7,5 Mio. Euro. Der CEO von Beiersdorf stellt mit 23,45 Mio. Euro den historischen Spitzenwert. mehr ...

Case Study Performance Management

Globales Performance Management

hkp/// group Experte Frank Gierschmann präsentiert ein Beispiel für das Design und die Implementierung eines globalen Performance-Management-Prozesses. mehr ...

Zwischen Anspruch und Wirklichkeit

Say on Pay aus globaler Perspektive

Investoren nutzen die Vorstandsvergütung als Hebel für die Einflussnahme auf die Governance von Unternehmen. Einblicke in die globale Marktpraxis des Say on Pay von John R. Sinkular, Pay Governance LLC., und Regine Siepmann, hkp/// group. mehr ...

Michael H. Kramarsch und Dr. Hans-Christoph Hirt im Interview

Vorstandsvergütung & Corporate Governance

Die Vorstandsvergütung steht seit einigen Jahren im besonderen Fokus von Investoren. Warum? Dieses und Weiteres erläutern Michael H. Kramarsch und Dr. Hans-Christoph Hirt im Interview mit Directors Academy. mehr ...

Stellungnahme zum Referentenentwurf

Gesetz zur Umsetzung der zweiten Aktionärsrechterichtlinie (ARUG II)

Offizielle Stellungnahme der hkp/// group zum Referentenentwurf des Gesetzes zur Umsetzung der zweiten Aktionärsrechterichtlinie (ARUG II). Der Fokus liegt auf Fragestellungen rund um das Thema Vorstandsvergütung und Say on Pay. mehr ...

Offizielle Stellungnahme der hkp/// group

Der neue DCGK – Inhaltliche Überarbeitung geboten

Die offizielle Stellungnahme der hkp/// group zur Neufassung des Deutschen Corporate Governance Kodex (DCGK). Der Fokus liegt auf Fragen der Vergütung des Vorstands und damit zusammenhängende Sachverhalte. mehr ...

Die hkp/// group Experten Regine Siepmann und Hannes Klingenberg im Gespräch mit hkp.com

Mehr Say als Substance

Die hkp/// group Experten Regine Siepmann und Hannes Klingenberg im Gespräch zu den Ergebnissen einer aktuellen Studie der hkp/// group zu den Abstimmungsrichtlinien der 40 Top-Investoren in DAX-Unternehmen. mehr ...

Proxy Guidelines der Top-Investoren im DAX im Fokus

Wenig Licht, viel Schatten

Abstimmungsrichtlinien zur Vorstandsvergütung werden selbst Mindestanforderungen nicht gerecht. Eine Analyse von hkp/// group, Universität Göttingen und DIRK - Deutscher Investor Relations Verband offenbart Handlungsbedarf. mehr ...

Michael H. Kramarsch und Dr. Jan Dörrwächter im Interview mit hkp.com

Massive Zäsur für Vorstandsvergütung und Aktienrecht

Der Referentenentwurf zum Gesetz zur Umsetzung der zweiten Aktionärsrechterichtlinie (ARUG II) liegt vor. Michael H. Kramarsch und Dr. Jan Dörrwächter erläutern maßgebliche Neuregelungen zur Vorstandsvergütung und ihre Konsequenzen. mehr ...

Best Practice für die Vorstandsvergütung - aus Sicht von Investoren, Aufsichtsräten und Corporate Governance Experten

Leitlinien für eine nachhaltige Vorstandsvergütung

Best-Practice-Leitlinien für eine einfache und nachhaltige Vorstandsvergütung - erarbeitet von einen Arbeitskreis mit namhaften Aufsichtsratsvorsitzenden, institutionellen Investoren, Wissenschaftlern und Corporate-Governance-Experten mehr ...

Aktuelle hkp/// group Analyse

Top-Management-Vergütung in Europa

CEO-Bezüge in den europäischen Top-Unternehmen steigen um 3%, bleiben aber unter dem Höchstwert von 2015. Vergütungen der Aufsichtsräte/Chairmen sinken dagegen erneut geringfügig. Schweiz bleibt das Vergütungsparadies für CEOs und Chairmen. mehr ...

hkp.com im Gespräch mit Regine Siepmann und Frank Gierschmann

Nachfolgeplanung als Stellschraube der Corporate Governance

Der hkp/// group Survey „Nachfolgeplanung für den Konzernvorstand“ zeigt: Gerade in Konzernen ist eine funktionierende Nachfolgeplanung weiterhin ein zentrales Element, um Vakanzen schnell mit den geeigneten Kandidaten besetzen zu können. mehr ...

Digitalisierungs- und Transformations-Expertise in Vorständen und Aufsichtsräten

Noch viel Aufholbedarf

Unternehmen sind auf der Suche nach Talenten, die im Themenfeld Digitalisierung und Transformation Verantwortung übernehmen. hkp.com sprach mit Regine Siepmann und Hannes Klingenberg über die Expertise auf Vorstands- und Aufsichtsratsebene. mehr ...

hkp/// group Analyse

DAX-Vorstandsvergütung 2017: Moderater Anstieg auf neues Allzeithoch

Gesamtvergütung der DAX-Vorstandsvorsitzenden steigt um 3,5% auf 7,4 Mio. Euro – Unternehmensgewinne klettern um 36%. Deutlich verbesserte Vergütungsberichte greifen Investoren-Forderungen auf. mehr ...

Aktuelle hkp/// group Studie

Vorstandsvergütung zwischen Unternehmensinteressen und Anforderungen von Investoren

Eine aktuelle Studie von hkp/// group und Ipreo analysiert die Besitzverhältnisse der im Börsenindex DAX gelisteten Unternehmen und die Entscheidungen der Top30-Investoren zu deren Vorstandsvergütung. mehr ...

Michael H. Kramarsch und Andreas Posavac im Gespräch mit hkp.com

Say-on-Pay: Unsichere Zeiten im DAX

hkp/// group und Ipreo haben die Besitzverhältnisse der Unternehmen im DAX analysiert und herausgefiltert, welche Investoren und Stimmrechtsberater in puncto Vorstandsvergütung wie agieren und welche Muster sich dabei abzeichnen. mehr ...

Michael H. Kramarsch und Dr. Jan Dörrwächter zur Regulierung von Stimmrechtsberatern

Ein kluger Schritt!

Mit Blick auf die bestehenden Interessenskonflikte bei Stimmrechtsberatern hat die Schweizer Börsenaufsicht von einer Regulierung vorerst abgesehen. hkp.com im Interview mit Michael H. Kramarsch und Dr. Jan Dörrwächter. mehr ...

hkp/// group Studie „Vorstandsvergütung DAX 2006 – 2016: Vorurteile und Fakten“

Vorstandsvergütung im Fakten-Check

Die hkp/// group Expertinnen und Studienautorinnen Regine Siepmann und Nina Grochowitzki erläutern die wesentlichen Hintergründe und Ergebnisse der hkp/// group Studie „Vorstandsvergütung DAX 2006 – 2016: Vorurteile und Fakten“. mehr ...

Schweizer Börse: Modifikation der Informations- und Transparenzvorgaben?

Regulierung von Stimmrechtsberatern

Michael H. Kramarsch und Dr. Jan Dörrwächter im Gespräch über die Überlegungen der Schweizer Börse, die Informations- und Transparenzvorgaben bei Rückgriff auf Stimmrechtsberater durch Unternehmen zu modifizieren. mehr ...

Vorstandsvergütung im ATX

Gagen hinter dem Vorhang

Die hkp/// group Experten Jennifer Schulz und Michael H. Kramarsch sprechen mit hkp.com über die Entwicklung der Vorstandsvergütung in ATX-Unternehmen 2016. mehr ...

Europäische Aktionärsrechterichtlinie erzwingt Wandel bei Corporate Governance und Vorstandsvergütung

Vorstandsvergütung: Zeitenwende für Österreich

Transparenz und Stärkung der Aktionärsrechte nicht zuletzt in Fragen der Vorstandsvergütung sind Ziele der neuen europäischen Aktionärsrechterichtlinie. EU-Mitgliedsstaaten haben zwei Jahre Zeit für die Umsetzung in nationales Recht. mehr ...

Aus dem hkp/// group Talent-Pool entwickelt

hkp/// group erweitert Geschäftsführung

Zum 1. Januar 2017 wurden Regine Siepmann und Frank Gierschmann zu Partnern, Mitgliedern der Gruppengeschäftsleitung und Geschäftsführern der hkp/// group ernannt. mehr ...

Nina Grochowitzki, Dr. Pia Lünstroth und Regine Siepmann im Gespräch mit hkp.com

Vergütung von Finanzvorständen in Deutschland

Wenn es um Vergütungsfragen in börsennotierten Unternehmen geht, stehen neben den CEOs die Finanzvorstände im Fokus. hkp/// group Expertinnen Entwicklungen in der Vergütung von CFOs in den DAX- und MDAX-Unternehmen. mehr ...

Vergütung deutlich unter international wettbewerbsfähigem Niveau

Aufsichtsräte im ATX weiterhin nicht angemessen vergütet

Eine aktuelle hkp///group Analyse zeigt: Die Vergütung der Aufsichtsratsvorsitzenden in den börsennotierten Top-Unternehmen Österreichs (ATX) steigt um rund 6 Prozent auf durchschnittlich rund 63.500 Euro. mehr ...

Daten zur Vergütung von Vorständen und Aufsichtsratsmitgliedern direkt verfügbar

boardpay.com gestartet

Das neue Board Compensation Portal der hkp/// group bietet direkten Online-Zugriff auf Vergütungsdaten von mehr als 10.000 Vorständen und Aufsichts- bzw. Verwaltungsräten der europäischen Top-Unternehmen. mehr ...

Gesamtbild der Vorstandsvergütung für 2015

DAX-Vorstandsvergütung 2015 einschließlich Volkswagen

Update zur hkp/// group Studie „hkp/// Geschäftsberichtsauswertung Vorstandsvergütung DAX 2015" - Berücksichtigung der veröffentlichten Werte für Volkswagen mehr ...

Personelle Unterstützung und Interim-Management

On-Site-Support

Ob erfahrener Senior Manager für das Interim-Management einer HR-Abteilung oder ein schlagkräftiges, junges Projektteam, das vor Ort bei der Implementierung eines HR-Instruments unterstützt – wir bieten Ihnen die passende Lösung. mehr ...

Weltweit führende Transparenzbestimmungen etabliert

DAX-Vorstandsvergütung 2015 – Reduzierte Vergütung bei sinkenden Gewinnen

Ergebnisse der Studie „hkp/// group Geschäftsberichtsauswertung Vorstandsvergütung DAX 2015" mehr ...

Deutlich gestiegene Bezüge

CEO-Vergütung in der Schweiz

Ergebnisse der hkp///group Studie „CEO-Vergütung in SMI- & SMIM-Unternehmen 2015“ mehr ...

hkpk/// group Analyse offenbart Diskrepanz zwischen Pay und Performance

Vorstandsvergütungen von ATX-Unternehmen steigen deutlich trotz rückläufiger Unternehmensergebnisse

Die Vergütungen der Vorstandsvorsitzenden in den größten börsennotierten Unternehmen Österreichs sind 2014 um 4,7% auf 1,6 Mio. Euro gestiegen - die Festvergütung sogar um 14%. mehr ...

Sinkende Vorstandsbezüge

2013 erneut leicht rückläufige Vorstandsvergütung im DAX

Gesamtbezüge der DAX-Vorstandsvorsitzenden für 2013 sinken leicht auf 4,97 Mio. Euro. Erstmals seit 2010 wird damit die Marke von 5 Mio. Euro unterschritten. mehr ...

Internationales Beratungsgeschäft gestärkt

hkp/// group und Pay Governance begründen strategische Allianz

Die neue transatlantische Partnerschaft der beiden Partner-geführten Beratungshäuser wird Kunden mit tiefer Expertise, herausragenden Marktkenntnissen und aktuellsten Informationen zu Entwicklungen und Trends im globalen Markt beraten. mehr ...

Aktuelle Analyse

Erfolgsorientierung und Nachhaltigkeit in der Vorstandsvergütung auch im MDAX

hkp/// Analyse belegt einen deutlichen Anstieg: So beläuft sich die durchschnittliche Direktvergütung eines Vorstandsvorsitzenden im MDAX für das Geschäftsjahr 2010 auf rund zwei Millionen Euro. mehr ...

Vorstandsvergütung im Fokus: Ein Leitfaden für Aufsichtsräte

Die Gestaltung der Vorstandsvergütung bleibt ein wiederkehrendes Thema auf der jährlichen Agenda von Aufsichtsräten. Doch wie verändert sich diese in ihrer Struktur und Ausgestaltung in Zeiten des aktuellen tiefgreifenden Wandels?

13. Mai 2024, Online

→ Information und Anmeldung