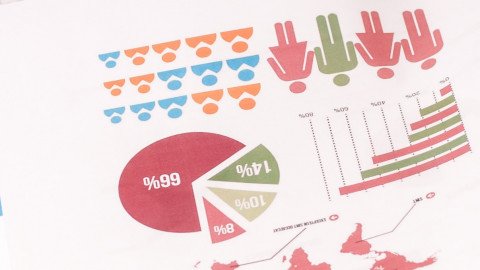

The most comprehensive analyses of worldwide market practice of equity-based compensation

Global Equity Insights Survey 2024

Equity-based compensation continues to grow in importance as persistent inflation and geopolitical tensions across the globe remain prevalent. For more insights visit the executive summary. read more ...

Strengthening competencies in the evaluation, organization and cooperation of supervisory bodies

hkp///group strengthens corporate governance consulting through the acquisition of the ECBE

hkp///group has acquired a majority stake in the European Center for Board Effectiveness GmbH. The ECBE specializes in evaluating and advising on the work of supervisory and administrative bodies. read more ...

hkp.com in conversation with Corporate Governance Advisor Dr. Pia Lünstroth

ATX: Sustainability in Supervisory Board and Management Board Compensation

What do the voting guidelines of leading ATX investors and proxy advisors say about the implementation of sustainability in management and supervisory board compensation? hkp.com talked to Corporate Governance Advisor Dr. Pia Lünstroth. read more ...

hkp/// group analysis confirms declining investor acceptance of DAX remuneration reports

Executive board compensation: mixed investor feedback on compensation report

A review of the votes on the compensation reports of the leading listed companies in Germany by the hkp/// group reveals a mixed picture for the 2023 Annual General Meeting season. read more ...

An interview with Dr. Jan Dörrwächter and Dr. Pia Lünstroth

Supervisory board role: corporate restructuring & IPOs

Restructurings and IPOs require good preparation and good corporate governance. In this context, the role of the supervisory board as guardian of good corporate governance takes on outstanding importance. read more ...

Expectations are rising – insights into supervisory board agendas

hkp// group Corporate Governance Advisors Nina Grochowitzki, Dr. Pia Lünstroth and Regine Siepmann in conversation on current topics of supervisory board activity. read more ...

More responsibility and liability requires targeted training and education

Training for Supervisory Boards: A long-term approach is needed

The tasks, responsibilities and liabilities of Supervisory Boards have become more diverse. Directors Academy CEO, Viktoria Kickinger, and hkp/// group Seionr Partner Jan Dörrwächter on the importance of ongoing qualification. read more ...

A commentary by Tobias Blumenstein and Dr. Pia Lünstroth

Executive compensation under compulsory scrutiny

Commentary on the Say on Pay results for listed companies against the backdrop of new corporate governance framework conditions – findings of a study by the University of Göttingen and hkp/// group. read more ...

Human Capital Management will soon be impacting the entire corporate landscape

HCM: By no means a fad

Human Capital Management and ESG as focus topics of the DGFP network meeting on September 8, 2022. read more ...

Dr. Jan Dörrwächter and Johannes Harrack interviewed by hkp.com

Maximum compensation: Implications for Management Board compensation systems

When the Second European Shareholder Rights Directive was implemented specific regulations on the maximum compensation were incorporated into the German Stock Corporation Act. An with Dr. Jan Dörrwächter and Johannes Harrack. read more ...

A comment by Michael H. Kramarsch

Facebook: Is social media socially sustainable?

In the German Börsen-Zeitung Michael H. Kramarsch argued why he thinks that social media, for the most part, is not socially sustainable and should be viewed much as we view the oil industry or the destruction of rainforests. read more ...

The most comprehensive analyses of worldwide market practice of equity-based compensation

Global Equity Insights Survey 2021

Volatile markets, external forces and global shocks have significantly influenced equity programs over the past year, according to the ninth edition of the Global Equity Insights Survey. Check out the study flyer for insights. read more ...

hkp.com talks to compensation experts Dr. Pia Lünstroth and Jennifer S. Schulz

ATX: Significant progress in the reporting of salaries

hkp.com talks to compensation experts Dr. Pia Lünstroth and Jennifer S. Schulz about the latest developments in the salaries of executive and supervisory board chairs in the leading listed companies on the Austrian stock exchange (ATX). read more ...

Press information on the hkp/// group analysis "Executive and Non-Executive Director Compensation in Europe 2020"

Corona shakes up CEO compensation in Europe

European top managers waive parts of their compensation due to the current crisis. Findings of the hkp/// group analysis "Executive and Non-Executive Director Compensation in Europe 2020". read more ...

An interview with Kay Bommer, Managing Director of DIRK - the German Investor Relations Association

HCM: new requirements for investor relations

After BlackRock focused its attention more on human capital management (HCM) at the beginning of the year, the question for IR is what the consequences will be. hkp.com in conversation with DIRK Managing Director Kay Bommer. read more ...

Update on the hkp// group analysis "Annual Report Evaluation of Executive Board Compensation DAX 2020

Compensation paid to DAX CEOs: two unconventional companies skew the overall picture

Now published record compensation of the CEOs of Delivery Hero and Linde turns previous significant decline into a significant increase in executive compensation in the DAX 2020. An update on the hkp/// group analysis. read more ...

The next generation of internal talent is joining the executive board of the international HR management consultancy

hkp/// group acclaims three new partners: Nina Grochowitzki, Dr. Pia Lünstroth, and David Voggeser

With Nina Grochowitzki, Dr. Pia Lünstroth, and David Voggeser, the hkp/// group is welcoming three new members to its circle of partners. All three consultants have been on board since the founding of the consultancy in 2011. read more ...

hkp/// group analysis “Annual Report Evaluation Management Board Compensation DAX 2020”

Corona puts an end to a decade of compensation increases among DAX companies

Compensation of DAX CEOs suffers the biggest slump since disclosure became mandatory: average compensation of DAX CEOs falls by 28% to an average of EUR 5.3 million in the face of sharply declining earnings so far. read more ...

Institutional investors are increasingly focusing on ESG (environmental, social, governance) issues - HCM aspects are being prioritized more than ever

Investors’ focus on Human Capital Management – opportunity for HR

At first, the investors' focus was on financials, then governance issues played a key role, followed by a broader view on sustainability. In the meantime, human capital management (HCM) issues are being prioritized more strongly. read more ...

A birthday letter from Michael H. Kramarsch

#10YearsForward: Shaping a better future together!

The hkp/// group celebrates its 10th birthday in 2021 - 10 years of commitment to a better, future-proof working world, in short: #10yearsforward. Founder and Managing Partner Michael H. Kramarsch looks ahead to the year of hope. read more ...

hkp/// group Expert Interview

Don’t let your remuneration policy ruin your IPO

A lot of preparatory work is needed for a successful IPO. In an interview with hkp.com, hkp// group experts Petra Knab-Hägele and Dr. Jan Dörrwächter explain which measures are important in HR and compensation. read more ...

The working group of well-known supervisory board chairs, institutional investors, academics and corporate governance experts presents an updated version of the Guidelines for Sustainable Management Board Remuneration

Updated Guidelines for Sustainable Management Board Remuneration

The Guidelines for Sustainable Management Board Remuneration, published for the first time in July 2018, are available now in an updated version in line with legal and regulatory changes. read more ...

Approval ratings and shortcomings based on the say-on-pay results of Austria’s leading listed companies at their 2020 annual general meetings

ATX companies: A wake-up call for Management Board compensation

Due to new legal and regulatory regulations, Austrian listed companies were forced to review the design of their Management Board compensation policies and put them to a ‘say-on-pay’ vote at their 2020 annual general meetings. read more ...

Michael H. Kramarsch on the quality of top investors' voting guidelines regarding Management Board compensation

Investors Say-on-pay voting lacks professional standards

"With great influence comes great responsibility!" - On LinkedIn Michael H. Kramarsch explains why most of the top 40 investors lack professional standards regarding say-on-pay votings at AGMs. read more ...

Press release on an analysis by hkp/// group, University of Göttingen and DIRK

Management Board Compensation: Participation challenges DAX investors

Despite improved transparency, there remains a lack of clarity and a considerable ambiguity with respect to the voting guidelines for Management Board compensation - an analysis by hkp/// group, University of Göttingen and DIRK. read more ...

hkp/// group analysis of “Executive and Non-Executive Director Compensation in Europe 2019”

Top management compensation between Corona crisis and social responsibility

European top managers waive parts of their compensation due to the current Corona crisis. CEO compensation of STOXX companies for the financial year 2019 remains at last year’s level. Findings of a recent hkp/// group analysis. read more ...

Dr. Pia Lünstroth and Dr. Jan Dörrwächter interviewed by hkp.com

Compensation with AktRÄG: The countdown is on

New requirements for upcoming annual general meetings in Austria are on the horizon. Dr. Pia Lünstroth and Dr. Jan Dörrwächter comment on the first experiences of implementing the Stock Corporation Amendment Act 2019 (AktRÄG). read more ...

Regine Siepmann and Dr. Jan Dörrwächter interviewed by hkp.com

ARUG II: Implementation moves forward

The Act implementing the Second European Shareholder Rights Directive into German law has been in force since the beginning of the year. Regine Siepmann and Dr. Jan Dörrwächter comment on the first experiences of implementing ARUG II. read more ...

Focus France: CEO compensation in Europe

CEO compensation levels in French CAC 40 companies have recorded a growth rate of 13.8% since 2017 – yet mainly due to changes in the index composition read more ...

The former hkp/// group Senior Partner Joachim Kayser interviewed by hkp.com

For more sustainability in compensation

Real estate is facing major challenges in a wide variety of different ways. A discussion with industry expert and former hkp/// group Senior Partner Joachim Kayser on backgrounds, solutions and the action that needs to be taken. read more ...

Dr. Jan Dörrwächter and Frank Gierschmann interviewed by hkp.com

Succession Planning - key task of Supervisory Boards

Why succession planning for managing board positions is an essential element of risk management within the company and what supervisory boards need to be aware of. Dr. Jan Dörrwächter and Frank Gierschmann interviewed by hkp.com read more ...

Regine Siepmann and Dr. Pia Lünstroth interviewed by hkp.com

Dawn of a new era for Board Compensation in Austria

The Austrian National Council passed the Shareholders' Rights Amendment Act (AktRÄG 2019) on July 2nd, 2019. After the approval of the Federal Council on July 11th, 2019, it is effective. read more ...

Moderate increase despite declining profits

DAX Supervisory Board remuneration 2018

The average total remuneration paid to the Chairmen of the Supervisory Board at DAX increased by around 4% in 2018 to €424,000. Decline in consolidated net profit illustrates decoupling of the company's success and shareholder interests. read more ...

SRD II will enforce fundamental changes in the decisions on executive board compensation

ATX Executive Board compensation before the transition

Compensation of the CEOs in Austria's top companies increased by around 16% 2018 - corporate profits fell. The European Shareholders Rights Directive will enforce changes in the decisions on Executive Board compensation. read more ...

Further moderate increases lead to yet another all-time high

DAX Management Board Compensation 2018

Total compensation for DAX CEOs increased by 3.6% to an average EUR 7.5 million whilst profits remained stable. Beiersdorf’s CEO earnings reached a new all-time high with EUR 23.45 million. read more ...

Case Study Performance Management

Global Performance Management

By presenting a concrete case study hkp/// group expert Frank Gierschmann shows an example for designing and implementing a global performance management process. read more ...

Regine Siepmann und Hannes Klingenberg interviewed by hkp.com

More Say than Substance

hkp/// group experts Regine Siepmann and Hannes Klingenberg discuss the results of a current study by hkp/// group regarding the Executive Compensation voting guidelines of the 40 top investors in DAX companies. read more ...

Proxy guidelines of DAX top investors in focus

Limited light, plenty of shadows

Voting guidelines for board compensation do not fulfill minimum requirements. A joint analysis by hkp /// group, University of Göttingen and DIRK reveals need for action against the backdrop of ARUG II. read more ...

Best Practice in Top Management Compensation

Guidelines for sustainable management board remuneration systems

A working group of well-known chairs of German supervisory boards, institutional investors, academics and corporate governance experts has presented guidelines for sustainable remuneration systems for German publicly listed companies. read more ...

hkp/// group Analysis

Earnings for top managers in Europe

CEO Compensation in leading European companies has risen by 3%, but remains below the peak value of 2015. By contrast, pay for Supervisory Board members is in marginal decline. Switzerland is a pay paradise for CEOs and chairpersons. read more ...

hkp.com interview with Regine Siepmann and Frank Gierschmann

Succession Planning as essential Corporate Governance Aspect

The hkp/// group Survey “Succession planning for board members” shows: A functioning succession plan is still a central element enabling to fill vacancies as quickly as possible with the best suited candidates. read more ...

New hkp/// group Analysis

DAX Management Board Compensation 2017: Moderate increase to a new all-time high

Total compensation for CEOs in the DAX increases by 3.5% to an average of EUR 7.4 million – corporate profits grow by 36%. Significantly improved compensation reports pick up on investors' requirements. read more ...

Recent hkp/// group analysis

Management board compensation between company interests and investor demands

Study by hkp/// group und Ipreo analyzes the ownership structure of DAX index listed companies and the decisions taken by the top 30 investors in relation to management board compensation. read more ...

Michael H. Kramarsch und Andreas Posavac interviewed by hkp.com

Say-on-Pay: uncertain times for DAX-companies

hkp/// group and Ipreo have analyzed the ownership structure of DAX-listed companies and worked out how different investors and proxy advisors act in relation to management board remuneration and what kind of patterns can be identified. read more ...

Michael H. Kramarsch and Dr. Jan Dörrwächter on the regulation of proxy firms

A smart move!

Given the current conflicts of interest, the Swiss Financial Market Supervisory Authority FINMA has declined to regulate proxy firms at this point, leaving it open for the government to propose legislation. read more ...

Swiss Stock Exchange: New Information and Transparency Regulations?

Regulation of Proxy Advisors

Michael H. Kramarsch and Dr. Jan Dörrwächter on possible amendments to the information and transparency regulations for the use of proxy advisors at the Swiss Stock Exchange. read more ...

Europäische Aktionärsrechterichtlinie erzwingt Wandel bei Corporate Governance und Vorstandsvergütung

Vorstandsvergütung: Zeitenwende für Österreich

Transparenz und Stärkung der Aktionärsrechte nicht zuletzt in Fragen der Vorstandsvergütung sind Ziele der neuen europäischen Aktionärsrechterichtlinie. EU-Mitgliedsstaaten haben zwei Jahre Zeit für die Umsetzung in nationales Recht. read more ...

Internal hkp/// group Talent Pool

hkp/// group management team grows

On January 1, 2017 Regine Siepmann and Frank Gierschmann were appointed Partners, members of Group management and members of the management team at hkp/// group read more ...

Nina Grochowitzki, Dr. Pia Lünstroth and Regine Siepmann interviewedy by hkp.com

CFO compensation in Germany

The public debate on compensation in stock companies often focuses not just on the CEOs but also on the Chief Financial Officers (CFO). hkp/// group experts about developments in CFO compensation at Germany's DAX and MDAX firms. read more ...

Compensation level still not competitive internationally

Supervisory board chairmen at ATX firms still not appropriately compensated

According to a new hkp///group study, the compensation of supervisory board chairmen of Austria's leading stock-exchange listed companies (ATX) rose by 5.6 percent. Despite the increase, chairmen are still not appropriately compensated. read more ...

Executve / Non-Executive Compensation Data directly accessable

boardpay.com launched

The new hkp/// group online platform offers direct access to publicly available, high-quality compensation data for more than 10,000 management and supervisory board members at Europe's top companies. read more ...

Complete picture

DAX-Vorstandsvergütung 2015 einschließlich Volkswagen

Update zur hkp/// group Studie „hkp/// Geschäftsberichtsauswertung Vorstandsvergütung DAX 2015" - Berücksichtigung der heute veröffentlichten Werte für Volkswagen read more ...

Personnel Support and Interim Management

On-Site-Support

Whether you a need an experienced senior manager to take charge of your HR department or a team of young consultants to help you implement a new HR tool, we have the right solution for you. read more ...

Wiorldwide lieading transparency regulations successfully established

Continuity and transparency in executive compensation at DAX companies 2015

Results of the hkp///group study "Executive compensation DAX companies 2015" read more ...

Increased level in Board compensation

CEO compensation in Switzerland

Results of the hkp/// group study „CEO compensation in SMI- & SMIM-companies 2015“ read more ...

hkp/// group analysis indicats gap in pay and performance

Despite declining net income CEO compensation in ATX companies increased in 2014

CEO compensation in the leading stock-listed companies in Austria increased by 4.7% up to 1.6 Mio. Euro in 2014. Base pay increased by 14%. read more ...

Aktuelle Analyse

Erfolgsorientierung und Nachhaltigkeit in der Vorstandsvergütung auch im MDAX

hkp/// Analyse belegt einen deutlichen Anstieg: So beläuft sich die durchschnittliche Direktvergütung eines Vorstandsvorsitzenden im MDAX für das Geschäftsjahr 2010 auf rund zwei Millionen Euro. read more ...