- European top managers waive parts of their compensation due to the current crisis

- For financial year 2020, CEO compensation of STOXX companies is at its lowest level since 2011

- Different reporting standards inhibit Europe-wide comparison of realized compensation

Executive and Non-Executive Director Compensation in Europe 2020

Frankfurt, June 4, 2021. In light of the economic crisis, the compensation of top managers of Europe’s leading publicly listed companies decreased significantly in 2020. With a minus of around 12%, the average CEO direct compensation of STOXX companies is at around EUR 5.3 million in 2020 and thus at its lowest level since the first hkp/// group analysis in 2011.

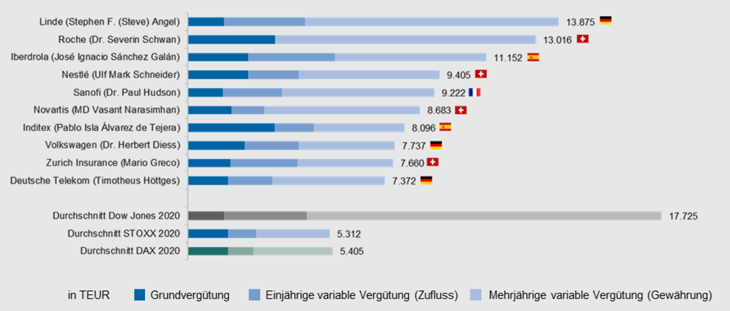

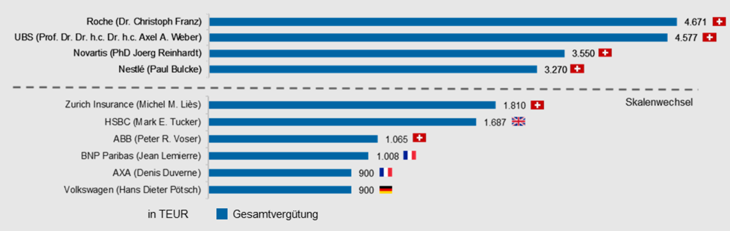

This development can be attributed to voluntary compensation waivers and – above all – to performance-related reductions in variable compensation. However, STOXX companies’ performance has been hit by the crisis to varying degrees, resulting in numerous changes in the ranking of highest and lowest paid CEOs. Notwithstanding, with around EUR 13.9 million, Linde’s CEO remains unchallenged at the top of the ranking. The highest CEO pay levels per country are once again reported in Switzerland – a picture that is even more striking when it comes to chairpersons. Roche’s chairman leads the ranking with EUR 4.7 million, followed by four other Swiss companies, UBS, Novartis, Nestlé and Zurich Insurance. In contrast to CEOs, the average total compensation of chairpersons in STOXX companies increased by 6% to around EUR 861 thousand. This opposing trend is due to the significantly lower or even non-existent link between the compensation of chairpersons and company performance.

These are the main findings of the analysis on “Executive and Non-Executive Director Compensation in Europe 2020”, conducted by the management consultancy hkp/// group. The assessment is based on information concerning the compensation of top management published in the current annual reports of companies listed in the STOXX® Europe 50 and EURO STOXX 50® indices.

While the high disclosure standard in Germany allows for an analysis of the compensation realized/paid out in one particular year, lower transparency requirements at the European level inhibit compensation comparisons which include, for instance, pensions and fringe benefits. “The disclosure practice in Europe equals a veritable ‘patchwork’ of different standards and requirements. The most significant limitation is that only the granted multi-year variable compensation can be compared across countries, but not the respective amounts actually realized during the financial year.”, explains Regine Siepmann, Partner and Head of Board Services at hkp/// group.

Focusing on the specific compensation developments, hkp/// group compensation expert Verena Vandervelt adds: “As predicted, due to the specific burden of the crisis on companies, we see significantly lower, but also highly varying CEO compensation levels in Europe this year. While compensation levels decreased in most industries, they actually increased in the health care and technology sectors.” The study author attributes the overall decline primarily to a weaker performance of the companies and the resulting reduction of the payout of annual variable compensation, but also to voluntary waivers of compensation elements. The latter, she adds, occurred more often in industries that were impacted most by the economic crisis.

Different transparency requirements inhibit Europe-wide comparison of actual compensation

As in the previous year, Linde’s CEO assumes the top position in the direct compensation ranking with EUR 13.9 million, followed by Roche (EUR 13.0 million) and Iberdrola (EUR 11.2 million). Nevertheless, there are also significant changes compared to the previous year's ranking. The CEO of Anheuser-Busch InBev, for instance, who had led the 2018 STOXX ranking with EUR 32.7 million, only came third to last in this year’s ranking with a direct compensation of EUR 1.24 million. This significant change can be explained by a base salary waiver and the lack of both an annual variable compensation payout and a multi-year variable compensation grant.

However, in order to make a reliable statement on the actual compensation realized in 2020, it is necessary to also take the payout of compensation elements into account. Due to payouts from share plans granted in previous years, the realized compensation of the CEO of Anheuser-Busch InBev amounted to around EUR 95 million in 2020. Similarly, the realized direct compensation of Linde’s CEO was EUR 50.8 million, by far exceeding the compensation disclosed under ICDS, which is comparable across Europe, but includes the multi-year variable compensation grant rather than the payout.

This year’s lowest CEO compensation among STOXX companies is reported by the Dutch STOXX newcomer Adyen. With a direct compensation of around EUR 600 thousand, the respective value clearly falls below compensation levels common across the index.

Fig. 1: Top 10 highest-paid CEOs in Europe in 2020, in k EUR

Regarding industries, the highest CEO direct compensation continues to be paid in the health care and consumer goods sectors. Due to European regulatory requirements, compensation in the financial industry shows the highest proportion of base salary. It currently stands at 39%, which is considerably above the average of all industries (28%).

Compensation waivers and declining performance

In light of the current COVID-19 crisis, a total of 22 STOXX CEOs have waived parts of their compensation in order to demonstrate solidarity with affected employees. Waivers occurred particularly frequently in French and Spanish companies as well as in the consumer and industrial goods industries that were most affected by the crisis. In 16 cases, the reductions relate to the base salary of the CEO, while 6 CEOs waived the annual variable compensation payouts and 3 waived the multi-year variable compensation grant.

“The CEOs' compensation waivers vary widely, ranging from purely symbolic gestures of a few percent of base salary to substantial sums of more than EUR 2 million”, explains hkp/// group compensation expert Verena Vandervelt. She also refers to the effects of the pay-for-performance logic in variable compensation systems, which led to a significantly lower annual variable compensation payout in 2020. “If there was any need for a litmus test for professional compensation systems in top management, the COVID-19 pandemic provided it".

Non-Executive Board compensation: Increase despite pandemic

Contrary to the CEO compensation, the STOXX chairperson compensation increased this year – by around 6% to EUR 861 thousand. “In many countries, non-executive director compensation is usually not linked to company performance and, contrary to CEO compensation, is therefore relatively stable, even in a year of crisis”, concludes hkp/// group Partner Regine Siepmann. In her view, the current increase in compensation can mainly be explained by regular increases in the non-executive board fees. Contrarily, only 12 chairpersons waived compensation, a lower rate than among CEOs.

As in previous years, companies headquartered in Switzerland lead the European ranking by a clear margin: Roche (EUR 4.7 million), UBS (EUR 4.6 million), Novartis (EUR 3.6 million) and Nestlé (EUR 3.3 million) dominate the ranking. These traditionally high compensation levels in Switzerland are partly due to the country’s corporate governance model and the associated greater variety of tasks for chairpersons.

Volkswagen’s chairperson, the first German representative in the ranking, takes the 10th place with a total compensation of EUR 900 thousand. The lowest compensation levels are paid by LVMH (EUR 47 thousand) and Essilor Luxottica (EUR 50 thousand), whose chairmen waived considerable parts of their compensation. The relatively low compensation levels at the bottom of the ranking can also be explained by governance aspects. The respective chairpersons are also CEOs of their companies and receive additional compensation for that role. For historical reasons, this constellation is often found in French companies, but it is being abandoned increasingly in order to achieve better corporate governance standards.

Fig. 2: Top 10 highest-paid chairpersons in Europe in 2020, in k EUR

Background information on the analysis

The hkp/// analysis of “Executive and Non-Executive Director Compensation in Europe 2020” evaluates the compensation of top managers in 72 companies from eleven countries which are listed in the main European stock indices – STOXX® Europe 50 and EURO STOXX 50®. The analysis is based on data from annual reports for the financial year ending in 2020.