Corporate Governance & Vorstandsvergütung

Impulse aus Kultur und Wirtschaft: Mit der hkp///group den Frühling feiern

Newsletter April 2024

Aktuelle Themen aus HR & Corporate Governance: u.a. Frühlingsempfang, Klimaschutz bei der hkp///group, Die hkp///group Story, Zukunft der Corporate Governance, Vorstandsvergütung im Fokus, hkp///group Transformation Lab, Gender Pay Gap, ESG mehr ...

Michael H. Kramarsch im Gespräch mit der Börsen-Zeitung

„ESG muss in alle Unternehmensprozesse“

Michael H. Kramarsch sprach mit der Börsen-Zeitung über die Verankerung von Nachhaltigkeit durch ESG-Ziele im Aufsichtsrat. Der Artikel steht Ihnen hier zum Download zur Verfügung. mehr ...

Digitalisierung, Start-ups & IT-Tools

Videointerview mit hkp/// group Senior Partnerin Petra Knab-Hägele

HR Analytics: Sinnvollere Entscheidungsgrundlagen durch Daten-Verknüpfung

Nach dem PPA-Summit sprach hkp/// group Senior Partnerin Petra Knab-Hägele über den Erkenntnisgewinn durch die Verknüpfung von Daten zu Workforce, Compensation und Performance - ihr Vortragsthema auf der Münchner Konferenz. mehr ...

Videointerview mit Martin Kersting, Professor für Psychologische Diagnostik an der Justus-Liebig-Universität Gießen

HR-Daten und People Analytics - die Erfindung des Mikroskops für HR

Am Rande des PPA-Summits sprach Martin Kersting, Professor für Psychologische Diagnostik an der Universität Gießen, mit hkp.com über das Potenzial datenbasierter Personalarbeit. mehr ...

Compensation & Benefits, Grading

Isabel Jahn und Jennifer S. Schulz auf personalwirtschaft.de

Gender Pay Gap: Die Wertigkeit einer Stelle muss analysiert werden

Eine faire Vergütung in Unternehmen gewinnt in der gesellschaftlichen Debatte zunehmend an Bedeutung. Das Grading hilft Arbeitgebern dabei, diskriminierungsfreie Vergütungsstrukturen sicherzustellen. mehr ...

Oliver Baierl, profilierter HR- und Regulatorik-Experte der Finanzbranche, wechselt zur hkp/// group

hkp/// group stärkt strategische HR Beratung

Seit dem 1. Oktober 2023 ist Oliver Baierl neuer Senior Director bei der hkp/// group. Er wechselt von der KfW Bankengruppe, für die er seit Mai 2015 in verschiedenen Positionen tätig war – zuletzt als Leiter Compensation & Benefits. mehr ...

Performance & Compensation Benchmarking

Jennifer Schulz und Isabel Jahn im Interview mit hkp.com

Fair Pay: Wofür will ich als Unternehmen wirklich vergüten?

Der Begriff Fair Pay erfreut sich immer größerer Aufmerksamkeit. Wo steht die Debatte, welche Erfolge und Herausforderungen sind zu verzeichnen? hkp.com im Gespräch mit den Beraterinnen Jennifer Schulz und Isabel Jahn. mehr ...

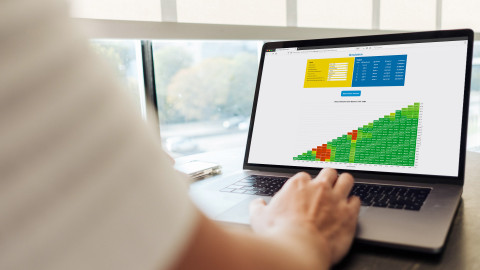

Petra Knab-Hägele und Verena Vandervelt über den hkp/// group Strategic Compensation Management Survey

Über Strukturbenchmarking Transformationen aktiv gestalten

Effektivität steigern, Kosten abbauen und eine tragfähige Neuaufstellung gewährleisten. Petra Knab-Hägele und Verena Vandervelt erläutern im Interview mit hkp.com den Nutzen des hkp/// group Strategic Compensation Management Survey. mehr ...

Teilhabe: Mitarbeiterbeteiligung & Aktienprogramme

Initiative von AGP Bundesverband Mitarbeiterbeteiligung, Deutsches Aktieninstitut und hkp/// group mit aktualisierter Datenbasis

Mitarbeiteraktie trotzt Corona, Krieg und Inflation

Die Plattform von AGP Bundesverband Mitarbeiterbeteiligung, Deutschem Aktieninstitut und hkp/// group belegt das Potenzial von Mitarbeiteraktien im nachhaltigen Vermögensaufbau. mehr ...

HR-Strategie & Transformation

Bewerbungsphase startet am 01. Februar und endet am 31. März 2024

HR Start-up Award: Mit Investoren-Verstärkung in die Bewerbungsphase

Die neunte Auflage des HR Start-up Awards startet mit drei neuen Jury-Mitgliedern aus der Investoren-Szene in die Bewerbungsphase: Jens Bender (HR Angels Club), Thomas Otter (Acadian Ventures) und Michala Rudorfer (Rose-Sky Investments). mehr ...

hkp/// group Remote Talk Serie zum Handlungsfeld Human Capital Management

Der Dialog zwischen HR und Investoren: Be there!

Welche Handlungsbedarfe ergeben sich für HR aus dem Investoren-Interesse an People Themen? Diese Frage beantworten hkp/// group Expert:innen in einer Remote Talk Serie. Dr. Harriet Sebald und Michael H. Kramarsch zum Investorendialog. mehr ...

Employee Experience Design & Agile Methoden

Ein hkp/// group Remote Talk über Employee Experience in der Praxis.

Erfolgskritische Mitarbeitende binden: Praxis-Case Sparkasse

Wie erhöht man mit einer positiven Employee Experience die Bindung erfolgskritischer Kolleginnen und Kollegen? Mit dieser Frage beschäftigten sich die hkp/// group und der Sparkassenverband Bayern. Ein Projekt-Gespräch. mehr ...

Alternative Ansätze zu klassischen Funktionsbewertungssystemen speziell mit Blick auf ihre Eignung für agile Organisationen

Klassische Funktionsbewertung in agilen Organisationen?

Der globale Wettbewerb zwingt Unternehmen, schnell auf Veränderungen zu reagieren. Daher muss auch ihre organisationale Aufstellung eine flexible Reaktion auf Impulse von Kunden, Lieferanten und Wettwerbern ermöglichen. mehr ...

Strategisches Talent Management

hkp/// group Consultants Karolin Schaper und Frank Gierschmann im Interview

Performance Management quo vadis – das Ende von Best Practices?

Wo geht die Reise im Performance Management hin? Die hkp/// group Berater Karolin Schaper und Frank Gierschmann im Gespräch zu aktuellen Entwicklungen. mehr ...

Dr. Harriet Sebald und Michael H. Kramarsch skizzieren für die DGFP-Fachzeitschrift Personalführung aktuelle Anforderungen an HR und definieren 5 Handlungsfelder für CHROs

Fokus auf Mitarbeiter: Aus ESG wird EESG

Die Erweiterung um ein „E" für Employee hilft, wertetreibende Faktoren und das strategische HR-Narrativ besser abzubilden. 5 Handlungsfelder für CHROs mehr ...

New Performance Management

Webinar-Serie Diversität – Teilhabe von Frauen an Wirtschaft und Wertschöpfung

Female Executive HR – Führungsetagen zwischen Wunsch und Wirklichkeit

Den Anteil von Frauen im oberen Management zu erhöhen, ist ein wichtiges Ziel vieler Unternehmen. Wie müssen entsprechende Programme aussehen? Was sind Best Practices? Sie erfahren es im hkp///group Webinar. mehr ...

Für Karrieren bis ins Top-Management müssen Talente früh erkannt, gefördert und befördert werden

Führungskultur: Mehr Mut zu Eliten

Für Karrieren bis ins Topmanagement müssen Talente frühzeitig erkannt, gefördert und befördert werden. Ein Kommentar von Carsten Schlichting für das FAZ Personaljournal. mehr ...

HR in Banken und Versicherungen

Eine Plattform für die Vergütungsverantwortlichen der Top-Institute in Deutschland - jetzt informieren

Top Banken Survey Deutschland

Die hkp///group bietet mit dem Survey Top-Banken Deutschland eine Plattform für Vergütungsverantwortliche führender Institute in Deutschland. mehr ...

Handelsblatt Banken-Gipfel 2022 – Ein Rückblick von hkp/// group Partnerin Isabel Jahn mit Fokus auf Herausforderungen für die HR-Funktion in Banken

Zeitenwende - Was beschäftigt die Finanzbranche?

Handelsblatt Banken-Gipfel 2022 – Ein Rückblick von hkp/// group Partnerin Isabel Jahn mit Fokus auf Herausforderungen für die HR-Funktion in Banken mehr ...

Karriere bei der hkp/// group

Female Executive HR – Führungsetagen zwischen Wunsch und Wirklichkeit

Den Anteil von Frauen im oberen Management zu erhöhen, ist ein wichtiges Ziel vieler Unternehmen. Wie müssen entsprechende Programme aussehen? Was sind Best Practices? Sie erfahren es im hkp///group Webinar.

26. April 2024, Online

→ Information und Anmeldung