Corporate Governance & Vorstandsvergütung

Impulse aus Kultur und Wirtschaft: Mit der hkp///group den Frühling feiern

Newsletter April 2024

Aktuelle Themen aus HR & Corporate Governance: u.a. Frühlingsempfang, Klimaschutz bei der hkp///group, Die hkp///group Story, Zukunft der Corporate Governance, Vorstandsvergütung im Fokus, hkp///group Transformation Lab, Gender Pay Gap, ESG mehr ...

Eine hkp/// group Studie des Beratungsbereichs Corporate Governance Advisory

Nachhaltigkeit im Spiegel von Investoren-Erwartungen

Eine hkp/// group Studie hat die Abstimmungsrichtlinien von DAX-Investoren in puncto Nachhaltigkeit analysiert. Ergebnisse verrät Regine Siepmann hier auf hkp.com sowie in einem Gastkommentar für die Börsen-Zeitung. mehr ...

Digitalisierung, Start-ups & IT-Tools

Videointerview mit hkp/// group Senior Partnerin Petra Knab-Hägele

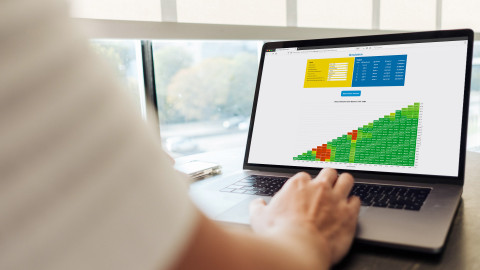

HR Analytics: Sinnvollere Entscheidungsgrundlagen durch Daten-Verknüpfung

Nach dem PPA-Summit sprach hkp/// group Senior Partnerin Petra Knab-Hägele über den Erkenntnisgewinn durch die Verknüpfung von Daten zu Workforce, Compensation und Performance - ihr Vortragsthema auf der Münchner Konferenz. mehr ...

Update zur Umfrage des Bundesverbands für Personalmanager BPM & Ethikbeirat HR-Tech

ArbeitnehmervertreterInnen blicken mit Skepsis auf den Einsatz von KI in der Personalarbeit

Mitbestimmungsseite und HR befürworten gleichermaßen klare ethische Rahmenbedingungen in der Nutzung von KI und modernen Technologien. Update zur Umfrage des Bundesverbands für Personalmanager BPM & Ethikbeirat HR-Tech. mehr ...

Compensation & Benefits, Grading

Isabel Jahn und Jennifer S. Schulz auf personalwirtschaft.de

Gender Pay Gap: Die Wertigkeit einer Stelle muss analysiert werden

Eine faire Vergütung in Unternehmen gewinnt in der gesellschaftlichen Debatte zunehmend an Bedeutung. Das Grading hilft Arbeitgebern dabei, diskriminierungsfreie Vergütungsstrukturen sicherzustellen. mehr ...

Henrike von Platen und Jennifer S. Schulz im hkp/// group Remote Talk

Fair Pay: Jetzt auf die Reise gehen

Henrike von Platen, Gründerin des Fair Pay Innovation Labs (fpi), und hkp/// group Vergütungsexpertin Jennifer S. Schulz sprechen über diskriminierungsfreie Vergütung, über Fair Pay Analysen und eine darauf basierende Zertifizierung. mehr ...

Performance & Compensation Benchmarking

Jennifer Schulz und Isabel Jahn im Interview mit hkp.com

Fair Pay: Wofür will ich als Unternehmen wirklich vergüten?

Der Begriff Fair Pay erfreut sich immer größerer Aufmerksamkeit. Wo steht die Debatte, welche Erfolge und Herausforderungen sind zu verzeichnen? hkp.com im Gespräch mit den Beraterinnen Jennifer Schulz und Isabel Jahn. mehr ...

hkp/// group Workforce Insights Snippets, Teil 4

Organisationsbenchmarks – Führungskräfteausstattung in unterschiedlichen Funktionsfamilien

Wie entwickelt sich die Anzahl an Führungskräften unterschiedlicher Wertigkeitsebenen in unterschiedlichen Funktionsfamilien? Antworten liefern die Vergütungsexpertinnen Verena Vandervelt und Sabrina Müsel. mehr ...

Teilhabe: Mitarbeiterbeteiligung & Aktienprogramme

Initiative von AGP Bundesverband Mitarbeiterbeteiligung, Deutsches Aktieninstitut und hkp/// group mit aktualisierter Datenbasis

Mitarbeiteraktie trotzt Corona, Krieg und Inflation

Die Plattform von AGP Bundesverband Mitarbeiterbeteiligung, Deutschem Aktieninstitut und hkp/// group belegt das Potenzial von Mitarbeiteraktien im nachhaltigen Vermögensaufbau. mehr ...

HR-Strategie & Transformation

Bewerbungsphase startet am 01. Februar und endet am 31. März 2024

HR Start-up Award: Mit Investoren-Verstärkung in die Bewerbungsphase

Die neunte Auflage des HR Start-up Awards startet mit drei neuen Jury-Mitgliedern aus der Investoren-Szene in die Bewerbungsphase: Jens Bender (HR Angels Club), Thomas Otter (Acadian Ventures) und Michala Rudorfer (Rose-Sky Investments). mehr ...

Recruiting, Mitarbeiterbindung und Neu-Bewertung von Benefits

Die wichtigsten Erkenntnisse aus dem Global ExecuNet IMEA Meeting in Dubai

In Dubai fand vor Kurzem das jährliche IMEA-Treffen (Indien, Naher Osten, Afrika) von Global ExecuNet statt - dem hkp/// group Netzwerk zum Austausch von Trends in den Bereichen Vergütung und HR. Event-Insights in Englisch. mehr ...

Employee Experience Design & Agile Methoden

Ein hkp/// group Remote Talk über Employee Experience in der Praxis.

Erfolgskritische Mitarbeitende binden: Praxis-Case Sparkasse

Wie erhöht man mit einer positiven Employee Experience die Bindung erfolgskritischer Kolleginnen und Kollegen? Mit dieser Frage beschäftigten sich die hkp/// group und der Sparkassenverband Bayern. Ein Projekt-Gespräch. mehr ...

Alternative Ansätze zu klassischen Funktionsbewertungssystemen speziell mit Blick auf ihre Eignung für agile Organisationen

Klassische Funktionsbewertung in agilen Organisationen?

Der globale Wettbewerb zwingt Unternehmen, schnell auf Veränderungen zu reagieren. Daher muss auch ihre organisationale Aufstellung eine flexible Reaktion auf Impulse von Kunden, Lieferanten und Wettwerbern ermöglichen. mehr ...

Strategisches Talent Management

hkp/// group Consultants Karolin Schaper und Frank Gierschmann im Interview

Performance Management quo vadis – das Ende von Best Practices?

Wo geht die Reise im Performance Management hin? Die hkp/// group Berater Karolin Schaper und Frank Gierschmann im Gespräch zu aktuellen Entwicklungen. mehr ...

Mit agilen Methoden kundenzentrierte HR-Arbeit umsetzen

Employee Experience Design

Wie gestaltet HR Lösungen und Services, die Mitarbeitende begeistern? Was muss kundenzentriertes Personalmanagement bieten? Mit agilen Methoden lassen sich diese Fragen effizient und effektiv beantworten. Die hkp/// group zeigt Ihnen wie. mehr ...

New Performance Management

Webinar-Serie Diversität – Teilhabe von Frauen an Wirtschaft und Wertschöpfung

Female Executive HR – Führungsetagen zwischen Wunsch und Wirklichkeit

Den Anteil von Frauen im oberen Management zu erhöhen, ist ein wichtiges Ziel vieler Unternehmen. Wie müssen entsprechende Programme aussehen? Was sind Best Practices? Sie erfahren es im hkp///group Webinar. mehr ...

Ein Impuls von hkp/// group Senior Partner Carsten Schlichting

Performance Management und Vergütung: Wie sich Leistung lohnt

Herausforderungen und Lösungen im Umgang mit der monetären Leistungsdifferenzierung und ihren Konsequenzen im Performance Management. Ein Impuls von hkp/// group Senior Partner Carsten Schlichting. mehr ...

HR in Banken und Versicherungen

Eine Plattform für die Vergütungsverantwortlichen der Top-Institute in Deutschland - jetzt informieren

Top Banken Survey Deutschland

Die hkp///group bietet mit dem Survey Top-Banken Deutschland eine Plattform für Vergütungsverantwortliche führender Institute in Deutschland. mehr ...

Eine Sonderauswertung der hkp/// group Top Banken Studie Deutschland 2022

Gender Pay Gap: Banken vs. alle Branchen

Die hkp/// group sorgt mit ihren Vergütungsstudien auch für Fakten im Bereich Entgeltgleichheit und hilft Unternehmen, diskriminierungsfreie Vergütung umzusetzen. Data-Insights aus der hkp/// group Top Banken Studie. mehr ...

Karriere bei der hkp/// group

Female Executive HR – Führungsetagen zwischen Wunsch und Wirklichkeit

Den Anteil von Frauen im oberen Management zu erhöhen, ist ein wichtiges Ziel vieler Unternehmen. Wie müssen entsprechende Programme aussehen? Was sind Best Practices? Sie erfahren es im hkp///group Webinar.

26. April 2024, Online

→ Information und Anmeldung