Pay equity or fairness has become a central point of discussion in society – both before and during the current economic crisis. Rooted in a focus on gender equality, the discussion has now broadened to encompass other public debates, such as the role of racial origin or the comparably low income of people working in system-critical jobs.

In parallel, European governments have increased pressure on businesses, introducing additional legislation on disclosure and reporting of compensation differentials between employee groups as well as more robust reporting requirements for other non-financial indicators. E.g. the European Parliament and Council require all member states to implement “the principle of equal opportunities and equal treatment of men and women in matters of employment and occupation” (Directive 2006/54/EC), which was adopted by the European Commission within the “Action Plan 2017-2019 Tackling the Gender Pay Gap” and which gave rise to various country-specific legislations.

Furthermore, increasingly sharp regulation is forcing more transparency on equal pay than most companies can currently offer. This, in turn, raises the profile of the issue among candidates, employees as well as shareholders. While employer branding and employee engagement are already embedded in corporate agendas, clear statements from institutional investors regarding equal pay are rather new. Among others, in 2018 BlackRock added to their engagement priorities: “statistics on gender and other diversity characteristics as well as promotion rates for and compensation gaps across different employee demographics”.

Given companies’ focus on good corporate governance, it would be rather surprising to find intentional or systematic discrimination. But do corporate processes effectively guarantee that all staff are treated fairly in terms of pay? Differentiated workforce analytics can help you both keep track of changes in the organization and monitor the status quo.

hkp/// group regards pay as a clear expression of corporate culture – and beyond that as one key indicator for fair treatment, in any respect. Based on a specific approach to fair pay analyses, hkp/// group experts identify not only existing pay gaps but more importantly the reasons behind these differences. Based on the results, hkp/// group consultants indicate possible areas of improvement and help you make the best use of the insights gained.

The hkp/// group approach uses pay as an indicator for fair treatment and identifies not only existing pay gaps but more importantly the reasons behind these differences.

Jennifer S. Schulz, Senior Manager hkp/// group

Equal pay for equal work

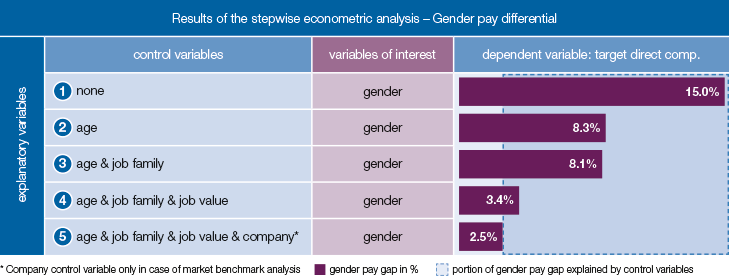

When calculating pay differentials, different approaches may yield different and sometimes even contradictory results. Based on the most frequently used methods in scientific publications on this topic, hkp/// group has developed a structured approach to define pay differentials. With this econometric method a comparison of different (employee) groups is possible on a like-for-like basis (ceteris paribus).

The comparison parameters are cumulatively expanded step-by-step, quantifying the drivers of the pay differentials. Fair pay analyses should consider a range of variables, provided necessary data is available. Each of these variables may help to explain differences in pay levels: gender, age (group), job (family), company grade, legal entity (within one company), industry (for a market comparison), location/country (within one company or for a market comparison) and other employee-specific characteristics, e.g. parentage, nationality, ethnicity.

To provide context and add explanatory approaches, hkp/// group experts conduct analyses on additional aspects – from the proportion of men and women per job grade or job family to the distribution of performance categories, bonus payouts and salary increases, as well as the frequency of promotion among different employee groups.

Illustration of a stepwise econometric analysis on gender pay differentials: by adding relevant control variables the analysis derives a meaningful picture