- Compensation for CEOs in leading European companies has risen by approximately eight percent due to a record high at Anheuser-Busch InBev

- Special effects distort the overall picture: Excluding Anheuser-Busch InBev, the increase was only 0.8%

- Switzerland remains a European pay paradise for CEOs and chairpersons

hkp/// group Analysis

“Executive and Non-Executive Director Compensation in Europe 2018”

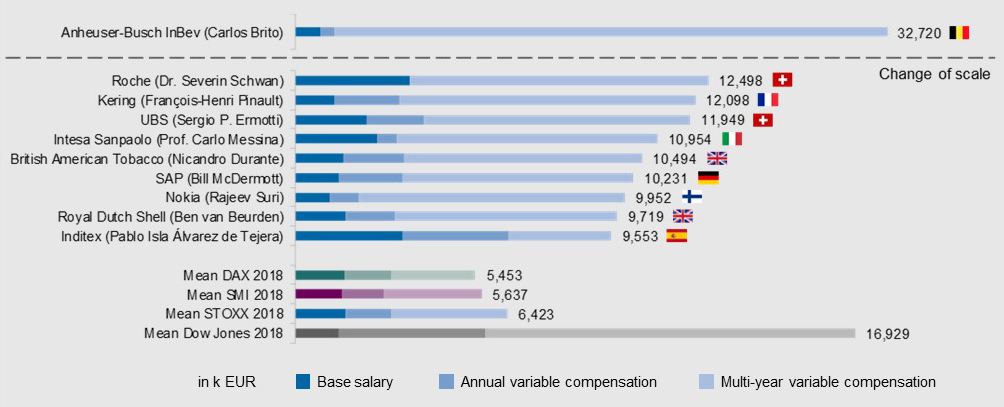

Frankfurt, May 28th, 2019. CEO compensation of Europe’s leading public companies (STOXX companies) increased by 7.8% in 2018 to an average of €6.4 million. The increase, however, is not directly attributable to a successful financial year, but to a special compensation element granted in an individual company. The CEO of the Belgian brewery group Anheuser-Busch InBev, the top of the European ranking, received a direct compensation of €32.7 million, of which approximately €25.2 million comes from a special stock option plan. Without this extreme value, the increase in the average CEO compensation is only 0.8% compared to 2017, which corresponds to the growth rate in the net income of STOXX companies.

On a country-by-country basis, the highest pay for CEOs – as in previous years – continues to be seen in Switzerland, followed by Spain and Germany, and the lowest in France. In terms of industries, the highest direct compensations continue to be paid in the consumer goods and healthcare industries. The financial industry, with an increase of 5.7% compared to 2017, continues to catch up since the collapse caused by last financial and economic crisis.

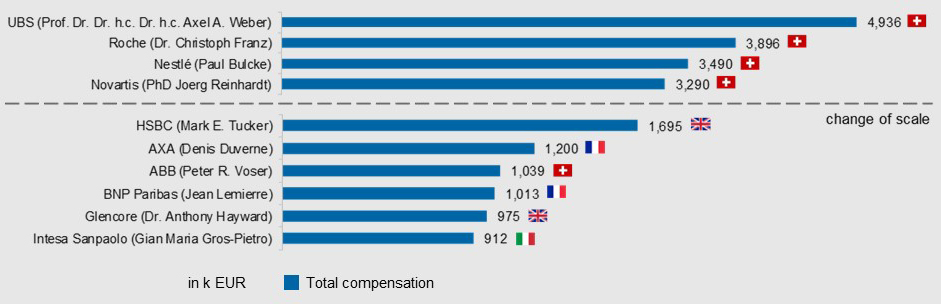

Following two years of decline, compensation for chairpersons of the supervisory boards and governing boards has started to increase again. For the financial year 2018, the average total compensation of chairpersons grew by 11.8% to 0.9 million. Also here, the Swiss companies lead the European ranking by a clear margin.

These are the findings of an analysis, entitled “Executive and Non-Executive Director Compensation in Europe 2018”, conducted by the management consultancy hkp/// group. The assessment is based on information concerning the compensation of the top management published in the current annual reports of companies listed in the STOXX® Europe 50 and EURO STOXX 50® indices. At the European level, only the multi-year variable incentives granted instead of paid out in 2018 are taken into consideration. Due to different disclosure practices, pensions and fringe benefits have also been excluded from the analysis.

“The Management Board compensation is now developing moderately in almost all European companies. However, numerous special cases, such as contract termination, change-of-control or strategic one-off incentives, are disrupting the overall compensation structure,” comments hkp/// group Managing Partner Michael H. Kramarsch. He refers to some special cases which also involve CEOs who are not active for the whole year, for instance, around €25.2 million of special multi-year variable compensation for the CEO of Anheuser-Busch InBev (full year in position), €41.4 million of vested pension benefits for the CEO of Linde (since October 2018) upon the change-of-control of the company and €17.8 million of severance pay for the former CEO of Volkswagen. “In many special as well as individual situations, care must be taken to ensure that a positive development in and of itself is not overshadowed by the special effects,” says Mr. Kramarsch. The corporate governance expert is convinced that, in the light of the European Shareholders’ Rights Directive, these special cases will become rarer because the influence of investors on Say on Pay resolutions will increase significantly.

CEO compensation – Fewer German companies at the top of the European ranking

According to the analysis of hkp/// group, the average direct compensation of CEOs (excluding pensions and fringe benefits) in STOXX companies amounts to around €6.4 million (€6 million excluding Anheuser-Busch InBev). Due to a special stock option plan in the amount of approximately €25.2 million, the CEO compensation of Anheuser-Busch InBev reached €32.7 million in 2018.

On the second place follows Roche’s CEO, whose compensation remains unchanged from 2017 at around €12.5 million. The third place goes to the CEO of the fashion and accessories group Kering, which has only been listed in the STOXX index since 2018. Also here, a special multi-year variable compensation of €5.8 million has been granted.

Among STOXX companies, ING Groep and Glencore have the lowest pay levels for CEOs, with €1.8 million and €1.2 million respectively, whereby the CEO of ING waived his variable compensation because of criminal proceedings and the Glencore CEO did so voluntarily.

The CEO of SAP, the highest-paid German top manager, ranks seventh in the European ranking with around €10.2 million. “Whereas the CEOs of the German automobile manufacturers Volkswagen, Daimler and BMW were among the top 15 highest-paid top managers among STOXX companies in the previous year, SAP is currently the only German company represented in this group. The DAX CEOs, currently averaging around €5.5 million, are well below the European average of €6.4 million,” says Verena Vandervelt, compensation expert of hkp/// group.

Fig. 1: Top 10 highest-paid CEOs in Europe in 2018, in k€

Walt Disney remains at the top of the US ranking (Dow Jones Industrial Average). In 2018, its CEO received compensation of around €55 million. Nike, as the company with the lowest CEO compensation in this group, pays its CEO around €8 million. The average level of CEO direct compensation in the Dow Jones Industrial Average (€16.9 million) is more than two and a half times as high as the European average.

Supervisory Board compensation: No changes at the top

As in previous years, chairpersons of Swiss companies again dominate the top of the European ranking: UBS (€4.9 million), Roche (€3.9 million), Nestlé (€3.5 million) and Novartis (€3.3 million). With compensations above the €3 million mark, they far exceed the STOXX average of €0.9 million. Following a downward trend in the last two years, the STOXX average rose by 11.8% compared to 2017.

The first German representatives included in the ranking are BMW and Fresenius, who share the 25th place with a compensation of approximately €0.6 million each.

Fig. 2: Top 10 highest-paid chairpersons in Europe in 2018, in k€

“Given the differences in governance systems, a direct comparison is only possible to a limited extent between the Supervisory Board in Germany and the Board of Directors in Switzerland or a chairperson under the US corporate governance,” comments hkp/// group Managing Partner Michael H. Kramarsch. He also points out the challenges for this analysis. For example, the boards are of different sizes: While in Germany both boards together have a total of 25 to 30 members, the international average is no more than half that number. “In the past, the workload of chairpersons in Switzerland was also higher than that of chairpersons in Germany. However, this is becoming increasingly similar,” says the corporate governance expert.

Improved disclosure practices

Regarding the disclosure of top management compensation in Europe, the authors of the analysis have observed a slight improvement over the years. “The pressure from investors and the public has recently shown impact on companies’ compensation reports. We expect that the European Shareholders’ Rights Directive will bring further improvements in transparency and comparability in the compensation of the Management Board.” hkp/// group manager Verena Vandervelt sounds convinced: “We do not yet know exactly what will ultimately be implemented at the European level; however, we hope that the internationally leading disclosure standards in Germany with GCGC model tables will also be achieved in other European countries.”

Background information on the analysis

The hkp/// analysis of “Executive and Non-Executive Director Compensation in Europe 2018” evaluated the compensation of top managers in 71 companies from eleven countries which are listed in the main European stock indices – STOXX® Europe 50 and EURO STOXX 50®. The analysis is based on data from annual reports for the financial year ending in 2018.

Contact hkp/// group:

Thomas Müller

Partner, Head of Marketing & Communication

Mobile + 49 176 100 88 237

Thomas.Mueller@hkp.com