The term ESG is on everyone's lips. And rightly so, since ESG bridges the gap between the interests of company shareholders and a broadly-defined group of stakeholders. In his latest letter of January 2022, Larry Fink, CEO of BlackRock (the world's largest institutional investor), discusses “his” CEOs in the best sense of “[...] effective stakeholder capitalism [...] driven by mutually beneficial relationships between you (the CEO) and the employees, customers, suppliers, and communities your company relies on to prosper”. (1)

The history of the emergence of ESG using the example of incisive events

However, ESG is not a new topic. Its history can be traced back to various milestones. Exemplary for the aspect “Environment” (E) is the Deepwater Horizon scandal from 2010 in the Gulf of Mexico, which led to a historic environmental disaster - as well as to a dramatic loss of value for the investors of BP, which had the platform operated by the company Transocean as a subcontractor.

The Enron scandal from 2001, where massive balance sheet falsifications led to the insolvency of the company, is a meaningful example for the topic “Governance” (G). Enron's stock price fell from $90 in August 2000 to just a few cents, resulting in a total loss for investors. As a result of the scandal's unraveling, the Arthur Anderson accounting group collapsed. In addition, the Sarbanes-Oxley Act was passed in 2002, which led to significantly higher requirements for corporate governance and transparency in reporting.

With the series of suicides among employees of the electronics manufacturer Foxconn 2010 or with recurring accidents in the Bengali textile industry (2), the aspect “Social” (S) represents the latest development in this series. It covers a wide range of topics, from human rights to training and qualification - and binding standards are still lacking for many topics.

From ESG focus to human capital management (HCM): the role of HR

Two trends are currently influencing the rapid development of ESG: On the one hand, they involve the preferences of a new generation - who want to invest their money (and inheritance) into sustainable products and investment opportunities. On the other hand, a wave of regulatory requirements - such as the EU Commission's draft Corporate Sustainability Reporting Directive, or more detailed requirements such as those of the European Financial Reporting Advisory Group (EFRAG), which is currently working on new standards for sustainability reporting.

The HR role and scope of work is also coming under scrutiny of institutional investors, due to the increasing relevance of Human Capital Management (HCM), which is reinforced by the global pandemic. BlackRock has currently sharpened its reconciliation guidelines with a view on HCM: “BlackRock has added language in its 2022 guidelines indicating an expectation that companies demonstrate 'a robust approach' to human capital management (HCM) and provide sufficient disclosure to enable shareholders to understand how a company's HCM approach aligns with its strategy and business model...”. (3)

The Investor's View of Human Capital Management

Two basic elements are decisive when it comes to the investor view on Human Capital Management: How HCM contributes to risk avoidance - for example, through a secure non-discriminatory salary structure - and which value drivers for company success can HCM influence positively, for example, reskilling a workforce in the framework of a company’s digital transformation.

In Larry Fink’s latest letter, an entire section is for the first time dedicated to the relationship between employees and companies, setting out specific requirements that companies should adress in their publications: “At BlackRock, we want to understand how this trend is impacting your industry and your company. What are you doing to deepen the bond with your employees? How are you ensuring that employees of all backgrounds feel safe enough to maximize their creativity, innovation, and productivity? How are you ensuring your board has the right oversight of these critical issues? Where and how we work will never be the same as it was. How is your company's culture adapting to this new world?”. (4)

HCM Reporting: Call for comparable, robust information grows louder

BlackRock is just one example of many. Investors are increasingly calling for detailed, comparable and reliable information. A further example named here is the current Voting Policy of the Voting Rights Advisor ISS. This emphasizes addressing a wide range of social factors - including increased disclosure and greater transparency of activities and information related to ESG issues. (5)

There have long been providers who collect information for investors concerning the workforce at companies. As an example, consider Britain-based Workforce Disclosure Initiative (WDI). It is part of the Share Action Initiative, an NGO dedicated to responsible investing. At WDI alone, the number of companies providing workforce information increased from 39 in 2018 to 50 in 2022. And the number of investors supporting the WDI has risen from 52 in 2021 to 62 in 2022. At the same time, companies that do not provide workforce data are pilloried in this framework “[...] these persistent non-responders are beginning to look like laggards with something to hide” and are also named.(6)

Reporting practice on human capital management aspects is heterogeneous

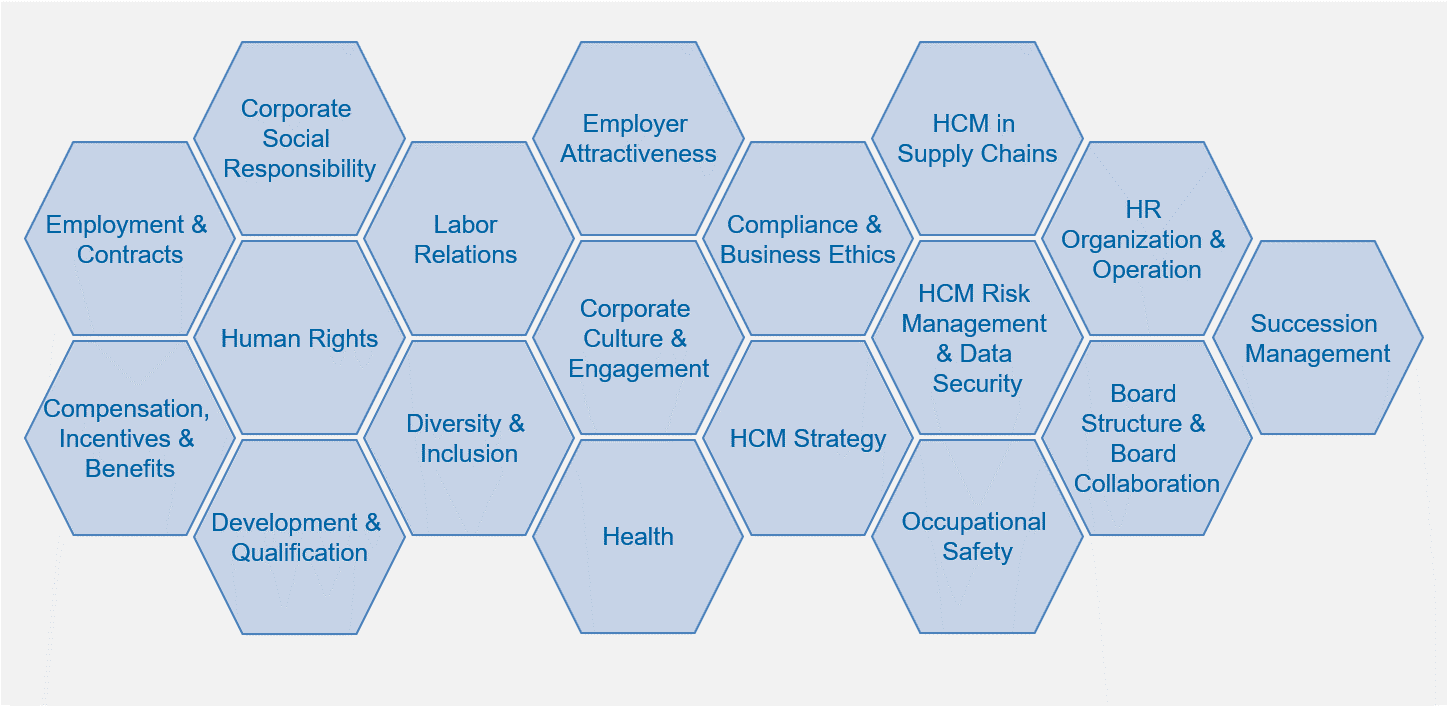

Even though many institutional investors have become more interested in HCM, there is still no standard definition. This leads to there still being no consistent requirements across all aspects of HCM on the investor side. At the same time, the reporting practices of companies are highly heterogeneous and therefore difficult to compare. Within the framework of the HCM Monitor DAX 2021 (7), the hkp/// group analyzed the relevant publications (annual, sustainability and personnel reports) of 28 DAX companies and, on this basis, developed the taxonomy of HCM categories depicted in Figure 1.

Figure 1: Categories of HCM taxonomy.

All considered DAX companies focus on the recommendations of the Global Reporting Initiative (GRI), a multitude of ILO key working norms or the Social Development Goals (SDG). However, not all topics that would be relevant as value drivers and risk factors are mapped in these frameworks. The topic of HR strategy, for example, is missing in all frameworks issued by UN initiatives such as GRI or SDG.

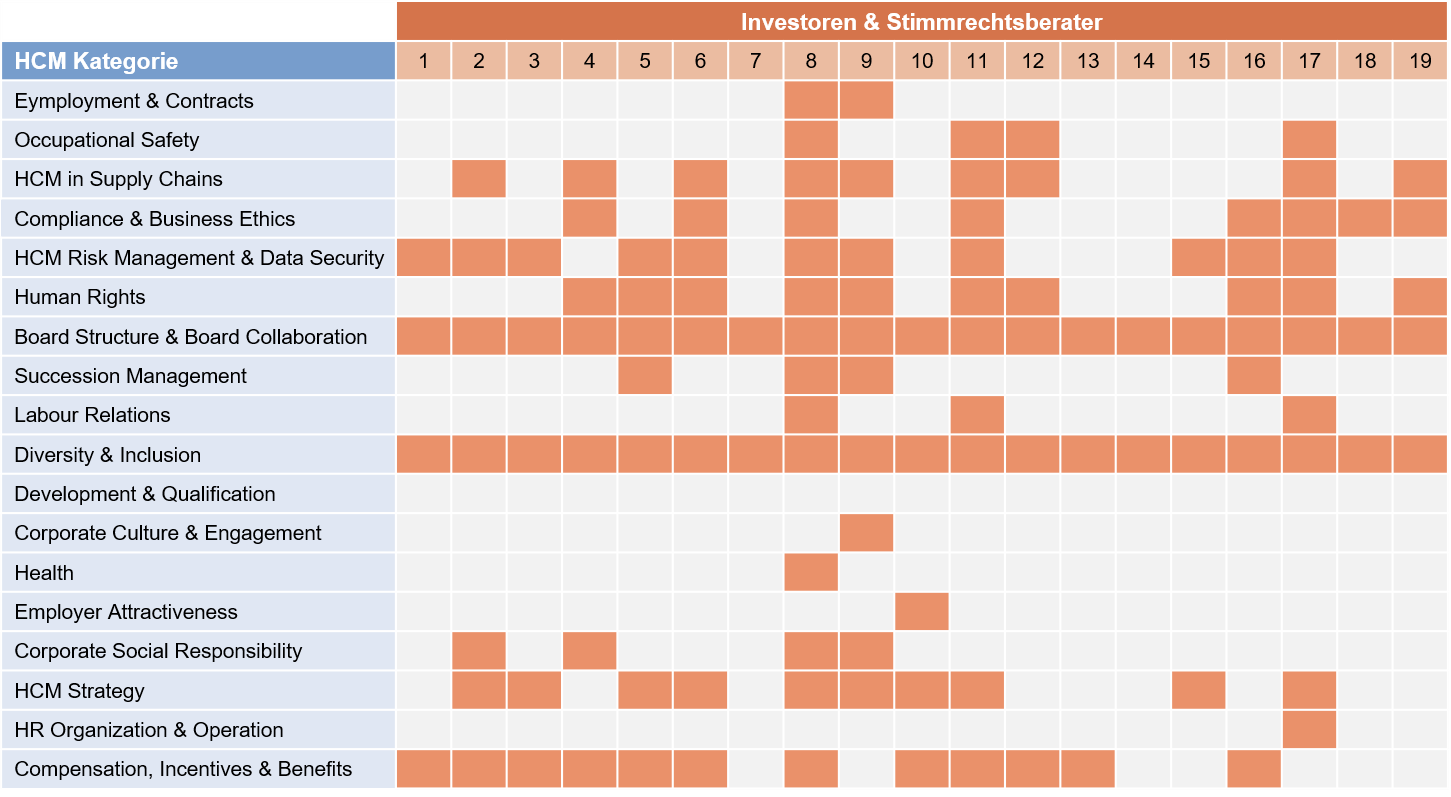

If investor expectations on HCM topics published in the context of voting guidelines are now reflectued upon the basis of this taxonomy, a heterogeneous picture emerges, as further hkp// group analysis shows (cf. fig. 2). Categories with specific HCM requirements from 19 of the biggest investors in DAX 40 companies in 2021 were therefore taken into account.

Figure 2: Coverage of HCM-specific topics in publicly available voting guidelines from selected top investors and voting advisors.

Two mismatches in investor expectations of HCM

Crucial is, that the pattern that becomes visible, indicates two mismatches. The first one being that in categories that may be assumed to be decisive for the transformation success of a company, such as training and qualification, the considered investors did not formulate any specific expectations.

The second mismatch to be noted is that for categories that are intensively sought after by investors, such as diversity and inclusion, companies may be very active in practice, but only show key figures on gender or a quota for women in their publication as part of the annual report, and only describe other important aspects of diversity management qualitatively.

A further important aspect is that the pattern evident here is only a snapshot, as investor expectations here will continue to evolve significantly.

From ESG to EESG: Employee, Environment, Social and Governance

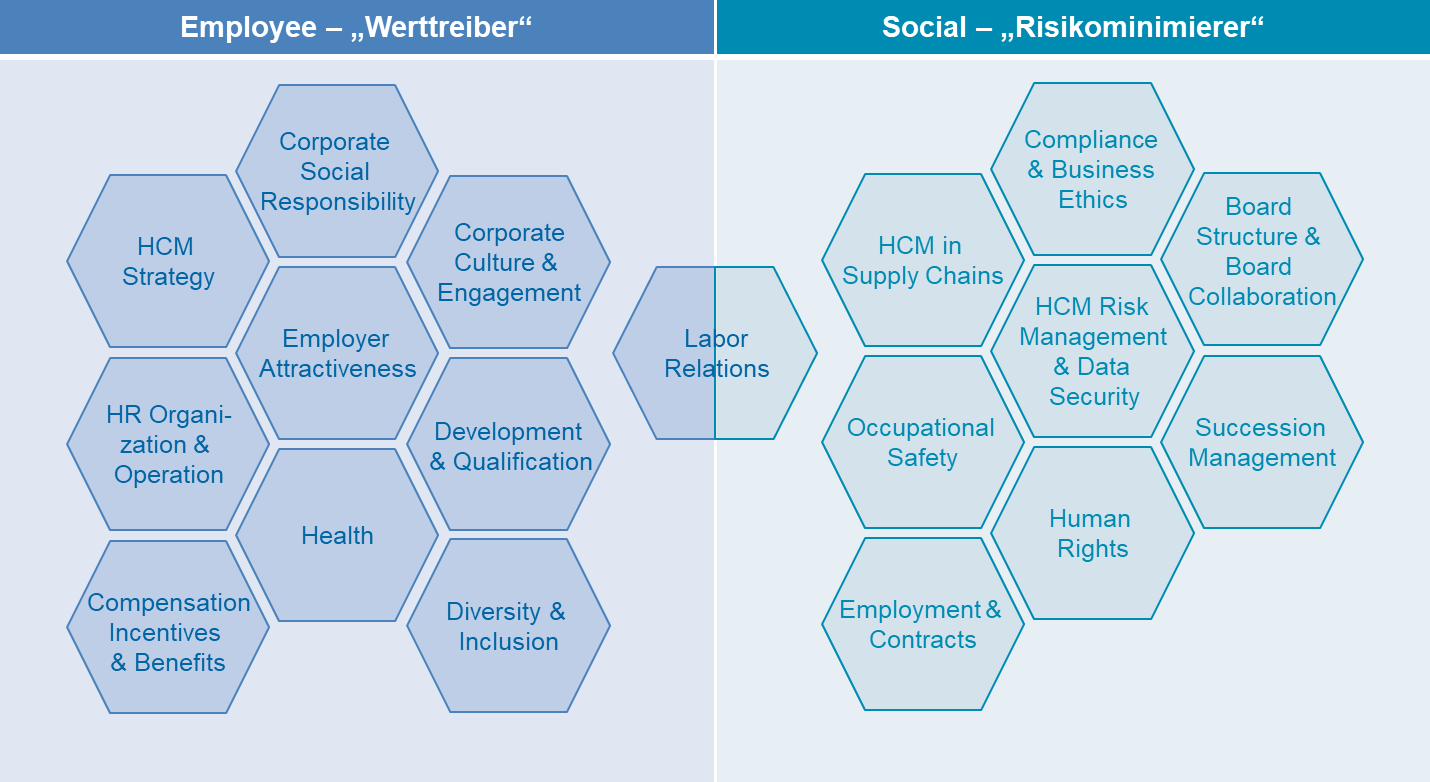

Instead of focusing on classical view on ESG, it is helpful to sharpen up the discussion by , ensuring there is talk about EESG, Employee, Environment, Social and Governance as some initial voices in the USA are already doing. (8) “Employee” here describes the relationship between employees and the company (e.g., the quality and quantity of the workforce, employee motivation, etc.) while “Social” describes the company's responsibility to the communities in which it operates (e.g., corporate social responsibility). Applying this logic to the taxonomy described above, the following picture emerges (fig. 3).

Figure 3: Division of the HCM categories into the Employee and Social areas

This distinction is furthermore helpful as the “social” area will foreseeably move in the direction of taxonomy, standardization, rating agencies etc. Therefore, companies will need to focus on meeting the required standards in the publication to avoid any risks.

HR strategy must take investor expectations into account

The “Employee” dimension is more multifaceted because it contains topics that represent value drivers for the company's success and are therefore not standardized, but in fact strategy-specific. Reporting can make a difference here in as it clearly depicts how human capital is dealt with and developed in a value-creating way within the framework of a company strategy.

This also means that when developing an HR strategy, investor expectations should come be considered, especially with regard to the “Employee” categories. The role of HR as a value driver can be communicated comprehensibly and company-specific. The focus should not be on using as many KPIs as possible, but rather on selecting those that can be relaibly reported annually based on the right data and therefore tell the correct “story”.

(1) Larry Fink, Larry Fink's letter to CEOs 2022 (2022).

(2) See e.g. ZEIT ONLINE GmbH, More than 100 dead in textile factory fire (2012), https://www.zeit.de/gesellschaft/zeitgeschehen/2012-11/brand-bangladesch-fabrik; tagesschau.de, More security, but... (2018) https://www.tagesschau.de/ausland/rana-plaza-gedenken-101.html; Mourning After Major Factory Fire (2021), https://www.tagesschau.de/ausland/asien/brand-fabrik-bangladesch-107.html.

(3) Georgeson, BlackRock Updates Voting Guidelines 2022, Hagel, Orowitz, Cassidy.

(4) Larry Fink, Larry Fink's letter to CEOs 2022 (2022).

(5) ISS, Continental Europe Proxy Voting Guidelines Benchmark Policy Recommendations 2022, p. 25 (2021).

(6) Siemens, for example. ShareAction, Press Worforce Disclosure Initiative (WDI) 13 Jan 2022 (2022), https://shareaction.org/news/half-of-ftse-100-respond-to-investor-calls-for-workforce-data.

(7) People focus on the rise - HCM Monitor DAX 2021. An analysis by the hkp/// group in collaboration with DGFP - the German Association for Human Resource Management, DIRK - the German Investor Relations Association and the Academy of Labor. Frankfurt, June 2021.

(8) John D. England, Considering a Culturally Congruent EESG and DEI Component in Incentive Plans (2021), https://corpgov.law.harvard.edu/2021/08/09/considering-a-culturally-congruent-eesg-and-dei-component-in-incentive-plans/.