Following the implementation of the Second European Shareholders' Rights Directive in ARUG II, shareholders of listed companies in Germany have been entitled to vote on the compensation system for the executive board at least once every four years at the annual general meeting since the 2020 financial year. This so-called Say on Pay sees owners granted extensive co-determination rights when it comes to using executive compensation as a central corporate governance element.

An empirical anasis as part of a Master’s thesis by the Chair of Management and Controlling at Georg-August University in Göttingen – led by Prof. Dr. Michael Wolff in collaboration with hkp/// group – regarding the Say on Pay results of listed companies (DAX, MDAX and SDAX) at annual general meetings in 2020 and 2021 demonstrated that votes on compensation are subject to different influencing variables.

Compulsory Say on Pay: Investors want a clear vote on compensation systems

The ARUG II saw the voluntary vote on compensation introduced in Germany in 2009 by the German Act on the Appropriateness of Management Remuneration (VorstAG) replaced by a compulsory vote. Under section 120a (1) of the German Stock Corporation Act (AktG), shareholders in listed companies must vote on the compensation system at least once every four years. According to this, a system is approved if 50% of the voting capital vote in favor. If it is rejected, the supervisory board must submit a reviewed compensation system for another vote at the next annual general meeting.

Specific substantive guidelines for compensation systems are displayed in detail in the German Stock Corporation Act. Under section 87a(1)(1) of the German Stock Corporation Act (AktG), the supervisory board must decide on a clear and understandable compensation system for the executive board. The purpose of a compensation system here is to define a maximum salary for executive board members, to define all financial and non-financial performance criteria for measuring variable compensation elements and to flesh out contractual provisions.

Broad approval for pay systems – not always with clear rates

For the first compulsory vote on compensation systems in 2020 and 2021, the majority of DAX, MDAX and SDAX companies were able to achieve an approval rating of more than 50% in the Say on Pay. Only in eight companies the compensation system was rejected by the owners: Aareal Bank, Aroundtown, Corestate Capital, Freenet, HelloFresh, MorphoSys, Qiagen and Rheinmetall.

Although a simple majority is sufficient for the approval of the compensation system under the requirements of the German Stock Corporation Act, institutional investors and voting rights consultants expect an approval rate of 75% to 80%. MDAX and SDAX companies in particular were unable to reach this threshold.

A linear regression model was used to investigate which factors had an impact on the vote results on the compensation system and how these factors can explain a certain vote. In addition to compensation aspects (presence of penalty and clawback rules, special bonuses and share ownership guidelines), the variables used also cover the use of ESG objectives and various control variables (including company size and performance) and shareholder structure (anchor shareholder and share of institutional investors).

The key results can be summarized as follows:

- Special bonuses in compensation systems lead to 9% poorer approval results on average. The explanation is obvious: A special bonus granted irrespective of the achievement of specific target variables contradicts the pay-for-performance philosophy. That is why it causes considerable criticism from international investors in particular.

- In contrast to this, share ownership guidelines are favored by shareholders and lead to better approval results (+6% on average). An obligation for executive board members to acquire and hold shares in their own company using their own means for the duration of their appointment contributes to an approximation of interests between the executive board and the owners.

- Furthermore, investors support taking into consideration a penalty rule in compensation systems that leads to 6% better Say on Pay results on average. Penalty rules enable the supervisory board to retain any variable compensation components not yet paid out, e.g. in the event of a compliance breach.

Current market insights 2022

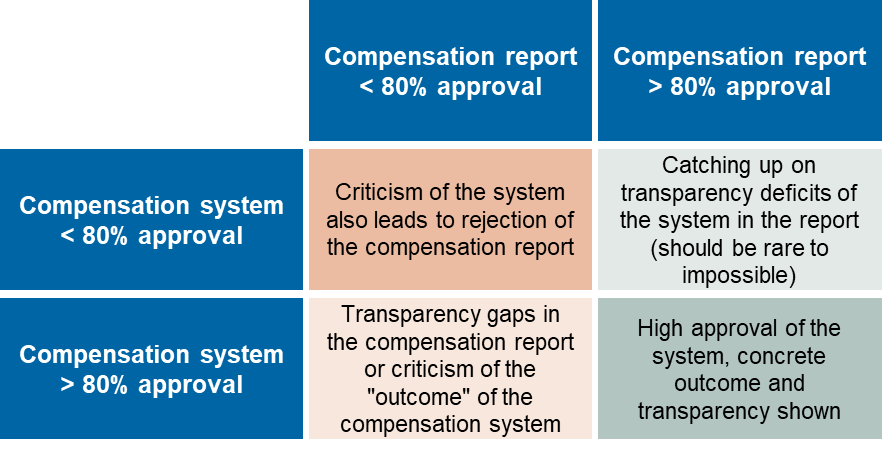

Following the implementation of the Second European Shareholders' Rights Directive, the executive and supervisory boards of listed companies must compile a clear and understandable compensation report under section 162 of the German Stock Corporation Act (AktG), which needs to be approved by the annual general meeting as part of section 120a of the German Stock Corporation Act (AktG). The compen¬sation report provides details on the practical application of compensation systems. Compensation reports were put to the vote at annual general meetings for the first time in 2022. This led to identifying the following connections between voting on compensation systems and reports:

Conclusion

The compulsory votes on compensation systems in 2020 and 2021 generally delivered positive results. Only a few compensation systems were rejected by the majority of investors. It became apparent across the board in this context that penalty rules and share ownership guidelines lead to better approval rates, while special bonuses lead to better vote results.

When looking at the practical application of compensation systems in compensation reports, initial analysis shows that investors’ key points of criticism concentrate on four issues: Pay-for-performance, transparency, compensation amount and discretionary elements.